What Is Blockchain Technology

The blockchain! It might sound like a medieval construction machine but it’s really a new type of distributed digital ledger, at the forefront of modern computer science.

The Blockchain” image credit: Spells of Genesis

“The Blockchain” image credit: Spells of Genesis You’ve probably heard the media describe the blockchain as “the technology powering Bitcoin.” You may also have heard that big banks are interested in using the blockchain – but not Bitcoin itself. So, if blockchains aren’t Bitcoin, what exactly are they?

Let’s start at the beginning, with the invention of the blockchain. “Satoshi Nakomoto” is the pseudonym of this technology’s mysterious creator, whose true identity remains unknown to this day. Satoshi released blockchain tech to the public in 2009, as the free Bitcoin software and a technical “white paper” describing the system.

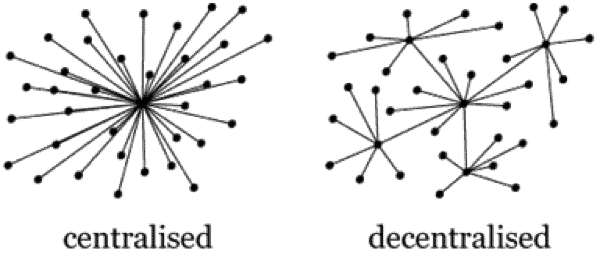

Satoshi’s revolutionary system allows an open computer network to create and share valuable data, without any central authority to keep the data synchronised and accurate. This is why the blockchain is sometimes called a distributed or “decentralised ledger.” It works in a strictly peer to peer way, similar to modern file-sharing systems like BitTorrent.

So, if Bitcoin trades through a public ledger book, the blockchain is the mechanism which keeps everyone on the same page and prevents accounting errors, accidental or deliberate.

This decentralised network architecture is one of several technologies which Satoshi fused together to create blockchain technology. Public-key cryptography is the second element. This technique is used to encrypt or decrypt information, without the necessity of participants first sharing and then maintaining the secrecy of a code.

The third and final element is proof-of-work hashing, which serves as evidence that computational work has been performed. Satoshi didn’t invent any of these technologies but, by combining them, he created the unique synthesis called the blockchain. Luckily, in-depth knowledge of these contributing technologies isn’t necessary to understanding our overview of the blockchain. Just keep in mind that they’re important gears in the digital machinery of the blockchain.

The first application of Satoshi’s blockchain technology was of course monetary; his creation of a secure online ledger which tracks ownership of the “digital gold” known as Bitcoin. In the future, it’s likely that blockchains will be how society tracks ownership of all kinds, such as stocks, bonds, property deeds and even legal contracts. This technology has tremendous disruptive potential across a host of industries.

But let’s focus on just Bitcoin for now… How does Bitcoin’s blockchain result in a fraud-proof public record which faithfully records all transactions, without any controlling agency to keep everyone honest? And again, just what is the blockchain?

As the name implies, the blockchain is a linear sequence of linked blocks. OK, so what are blocks? To answer this question, we need to briefly explain how the Bitcoin network functions. You may have heard of Bitcoin miners. If not, our previous video, “What is Bitcoin Mining?” explains how mining works within Bitcoin.

Basically, miners record all Bitcoin transactions into data bundles known as “blocks.” These blocks are linked together in linear sequence by means of a special code. Each transaction in a block goes into forming this code; the final output is recorded in that block. The next block forms a new code and includes the previous block’s code, and this process repeats. Code-chaining all blocks together ensures the permanency of prior transactions – you can’t change information in prior blocks without also changing all subsequent blocks. Together, these linked blocks form an ever-growing public record of all Bitcoin transactions, known of course as… the blockchain.

Now that the term makes a little more sense, let’s explain the blockchain in greater depth by using an example. Let’s say you send some bitcoins to your friend. Your transaction will be relayed across the entire Bitcoin network – everyone will see that address A, your address, is trying to send however many coins to address B, your friend’s address.

People running so-called “full nodes” – in other words, Bitcoin software clients that store the complete blockchain – will quickly receive information about your transaction. Full nodes then verify your transaction’s information against their stored copy of the blockchain. So, full nodes will check whether address A holds enough Bitcoin to pay the specified amount to address B. They’ll also check other new transactions to verify A isn’t trying to send the same coins simultaneously to B and address C or addresses C, D, E and so on.

Although there’s no upper multiplier to how many times coins might be counterfeited in such a manner, that particular form of fraud is known as a “double-spend.” It’s important to note that double-spends were a major technical problem preventing reliable peer-to-peer electronic money – at least until Satoshi’s blockchain solution!

Double-spends aside, let’s return to our example. If your transaction is approved by full nodes, it’ll soon be transmitted to a special type of full node (and sometimes, your transaction will reach the special full node first). These special full nodes have the opportunity to record blocks of transactions into the blockchain. And if you guessed that these special nodes are called “miners,” you’d be right!

Currently, the reward for the first miner to solve an equation specific to current transactional information and so form a new block is 25 bitcoins. That might sound like a lot of money just for recording blocks! But mining is how the blockchain is maintained and secured, so miners deserve a good reward.

Bitcoin’s blockchain, in which miners compete to write the next block for a reward, is known as “Proof of Work” hashing. The work in question refers to hashing, or solving a mathematical equation which reduces information of any length to a fixed length.

Elegantly, Bitcoin adjusts this equation’s difficulty, periodically and automatically, to meet the amount of computing power dedicated to its solution. Such difficulty adjustments ensure a new block is written every ten minutes, on average. In Bitcoin’s early days, difficulty was low and blocks could be reliably solved using a single laptop. As the value of Bitcoin rose, so did difficulty as mining became increasingly competitive. Today, mining is performed on specialised hardware, housed and cooled in vast data-centres, such as this one:

Read more: What is the Blockchain? | 99Bitcoins