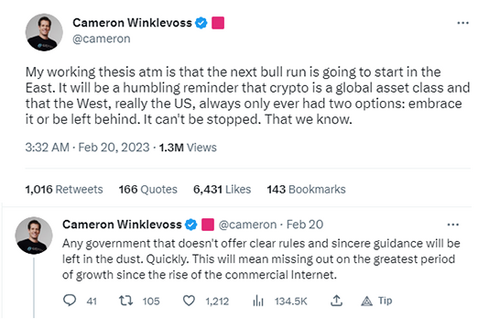

Many in the cryptocurrency industry have attempted to predict when the next crypto bull run will commence. Much of it is speculation, so we can’t be sure when, but a few crypto veterans believe they know what regions will drive the next crypto market bull run. In February of this year, Gemini crypto exchange co-founder, Cameron Winklevoss, said that the next crypto bull market would come from the East.

His statement on Twitter referenced that countries in the East have been embracing crypto by introducing sensible regulations that could result in record levels of institutional investment. As per the sentiments of Coinbureau.com, this article explores five countries that could be the primary drivers behind the next bull market, when they could pass pro-crypto regulations, and

which cryptocurrencies will benefit.

Image source: Twitter

The first country to watch is the United Arab Emirates (UAE). The UAE introduced its first pro-crypto regulations in 2018 when it announced its Blockchain Strategy 2021. However, it wasn't until early 2022 that the crypto industry started to migrate to Emirate cities like Dubai. That's because early 2022 is when the UAE announced that it would introduce a federal license for so-called Virtual Asset Service Providers (VASPs), including cryptocurrency exchanges.

This federal license effectively combined all the crypto licenses the country had created by that time. In the following months, there were plenty of headlines about businesses, such as international schools accepting crypto payments and government agencies dabbling in Metaverses and NFTs. The UAE Ministry of Economy even set up a virtual headquarters in a custom metaverse.

Source: YouTube

By the end of 2022, the UAE was home to over 1.5K crypto projects and companies. Most of these projects and companies moved to Dubai, which caused FOMO from other Emirate cities, such as Abu Dhabi. It announced multibillion-dollar crypto initiatives to get in on the rush. Earlier this year, the UAE Minister for foreign trade announced that crypto would play a significant role in UAE trade.

Although the UAE's crypto adoption is bullish, banking access is one minor issue holding it back from its full potential. According to UAE crypto regulation analyst, Wealthy Expat, pro-crypto regulation has yet to make UAE banks more comfortable opening accounts for crypto clients. It may have to do with the fact that the Financial Action Task Force (FATF) put the UAE on its grey list last March.

For reference, being grey-listed means it becomes harder to transact with the global banking system, as explained in this article highlighting five institutions' efforts to thwart the crypto industry. It’s not ideal for crypto projects and companies seeking to cater to International clients, and it's a big part of why the UAE has taken proactive steps to get itself off the FATF's grey list.

Such steps include tightening regulations around privacy coins and demanding more information from crypto projects and companies. As noted by Wealthy Expat, these revamped crypto regulations should make UAE banks more comfortable servicing crypto clients. And with a bit of luck, also be enough to get the UAE off that grey list. If both outcomes occur, it will finally open the floodgates for crypto capital in the country.

However, there is one hindrance to crypto investing in the UAE, as there continues to be uncertainty about which cryptos are allowed according to Islamic law. For context, gambling is forbidden in Islam; it's safe to say that much crypto investing is no different from gambling. That's why it makes sense that the UAE is especially keen on the Metaverse and NFTs. The digital property aspect of these two crypto niches makes them more palatable from an Islamic perspective.

As such, Metaverse and NFT cryptos could see the most significant inflows from the UAE's ongoing crypto adoption. While it's unclear when the UAE will finalize its revamped crypto regulations or get off the FATF's grey list, both will likely happen by the end of the year. This ultimately depends on how much the UAE complies with requests from the US government, which controls the FATF.

Image source: Al-Monitor

The second country to watch is Saudi Arabia. In contrast to the UAE, the Saudi government banned banks from processing crypto-related transactions in 2018. The government also declared that crypto trading was illegal, but there are reportedly no punishments for those who trade. The absence of penalties is probably why a significant percentage of Saudi citizens hold and trade crypto.

According to a survey by KuCoin in May last year, around 14% of Saudi adults had held or traded crypto over the previous six months. Another 17% were interested in crypto. Now, the apparent popularity of crypto in Saudi has given rise to so-called Halal-approved crypto products, which began making the crypto headlines late last year.

Around this time, the Saudi Central Bank announced that it had hired a crypto expert to assist in crypto policy. Also, Binance is already doing business with the country, proving that Saudi is seriously considering pro-crypto regulations. Further evidence can be found in the unexpected announcement in February that the Saudi government had partnered with the crypto project, The Sandbox, for metaverse development. This further underscores the appeal of the Metaverse and NFT niches to countries with Islamic considerations.

Although it's still too soon to say if Saudi Arabia will adopt crypto to the extent of the UAE, geopolitics is pushing the oil kingdom in that direction. As some may have heard, Saudi Arabia's relationship with the United States is getting weaker while its relationship with China is getting stronger.

Saudi Arabia is reportedly considering pricing some of its oil sales to China in Yuan. This is a big deal because Saudi Arabia is supposed to price all its oil in US dollars. Pricing even just a portion of its oil in Yuan would weaken the US dollar, upsetting the United States. Here's where things get very interesting.

The Saudi Riyal is pegged to the US dollar at a rate of 3.7 SAR to 1 USD, which has been the case since 1986. If Saudi Arabia was to do something to upset the US, such as sell its oil in foreign currencies, the US could retaliate by restricting Saudi Arabia's access to USD. The Saudi government is hyper-aware of this, and possibly why the Saudi Central Bank is considering the development of a Central Bank Digital Currency (CBDC). A digital Saudi Riyal could allow Saudi Arabia to eliminate its currency’s dependence on the US dollar.

That approach may be problematic as other countries may feel uncomfortable accepting a Saudi CBDC as payment. One solution could be to develop a new kind of Reserve currency, such as the one being considered by the BRICS countries, or they could simply adopt cryptocurrency instead.

The crypto approach may seem far-fetched until you consider that Iran, another Islamic country, allowed businesses to use crypto for trade last year. Moreover, China recently brokered a peace deal between Saudi Arabia and Iran, so Iran may use crypto for trade with Saudi Arabia which could make Saudi more comfortable doing the same.

If Saudi Arabia does start using crypto for trade, the Gulf countries would likely follow suit because the currencies of most Gulf countries are also pegged to the US dollar. Chances are, they're itching to escape US influence as much as Saudi is, and possibly why the UAE is rushing to roll out a CBDC too.

Image source: Cryptopolitan

The third country is Hong Kong which is essentially part of China, highlighting the importance of Hong Kong's crypto adoption because it bodes China doing the same. For reference, China banned crypto in 2018 and eradicated what was left of the industry in 2021. Hong Kong was initially seen as a safe haven for Chinese crypto companies and projects, but this changed after the heavy-handed takeover of the authorities following mass protests in 2019 and 2020.

In late 2020, Hong Kong banned retail crypto trading and cracked down on the crypto industry. In early 2022, Hong Kong started targeting stablecoins. Officials later confirmed this was because stablecoins could undermine a Hong Kong CBDC. The Hong Kong dollar is also pegged to the US dollar, suggesting that Hong Kong could likewise be trying to escape US influence with a CBDC.

In mid-2022, Hong Kong officials noted that some NFTs require additional regulations. This suggests that the country may not be as open to Metaverse and NFT niches as the UAE and Saudi Arabia, and this may be due to China's strict control of social media and the desire to maintain it. In late 2022, Hong Kong officials noted they wanted CBDCs used in DeFi. Officials later explained that they wanted to create a CBDC-backed stablecoin.

Then, Hong Kong officials out of nowhere announced they were considering legalizing retail crypto trading and investing. By the end of 2022, Hong Kong had committed to attracting over 1,000 crypto companies and projects to its jurisdiction over the next three years—a complete 180° in attitude.

Earlier this year, Hong Kong officials specified that they wanted to restrict retail crypto investment to the largest and most liquid cryptocurrencies. This suggests that cryptos like BTC and ETH could be the biggest beneficiaries when retail crypto trading and investing become legal on June 1st, 2023.

Image source: Twitter

Not surprisingly, it was reported that the Chinese government had signed off on Hong Kong's crypto plans. Also, Chinese banks are reportedly trying to provide banking services to crypto companies and projects in Hong Kong despite crypto being illegal on the mainland. Hong Kong banks have also begun offering crypto-to-fiat conversions to their clients.

Meanwhile, in China, the courts confirm that holding crypto is entirely legal despite all the restrictions. In combination, this suggests that the crypto inflows from Hong Kong will be truly massive. However, there are just two caveats: First, Hong Kong officials appear to oppose everything except crypto investing. Non-CBDC stable coins will be off-limits, and DeFi will be restricted too. One Hong Kong official noted last year that financial privacy would not be permitted either.

Still, the inflows into large-cap cryptocurrencies could be enough to kick-start a new crypto bull market. Consider that Cameron's comments about the crypto bull market coming from the East were a reference to Hong Kong. Other crypto heavyweights, like Arthur Hays, have said the same. If all this becomes evident, it will likely result in pro-crypto competition in East Asia, much like the pro-crypto competition in the Middle East. It could result in Hong Kong removing many of its stablecoin, NFT, Metaverse, and DeFi-related restrictions to remain competitive.

Image source: CNN

The fourth country to watch is Singapore, which seems to have a love-hate relationship with cryptocurrency. The government denied hundreds of crypto licenses, banned crypto-related advertising, and shut down crypto ATMs early last year. On the flip side, however, KPMG found that crypto investments in the country had increased by more than 13x in 2021.

Singaporean banks started expanding their services to retail investors in early 2022, and multiple large crypto companies, including Circle and Coinbase, secured crypto licenses. Moreover, Singaporean companies have been exploring crypto payments, and the Singaporean government has been exploring tokenizing assets on Smart contract cryptocurrencies.

Yet, between these bullish headlines, there's been no shortage of bearish crackdowns on the crypto industry. Most of the crackdowns came after the crypto hedge fund Three Arrows Capital (3AC) collapsed, based in Singapore. Given that 3AC’s failure was caused by the implosion of Terra’s UST stablecoin, stablecoins were among the crypto niches Singaporean regulators targeted.

Singaporean regulators also floated the idea of restricting the participation of retail investors in crypto but opted to introduce revamped crypto regulations for everyone instead. In late 2022, they discussed requiring retail investors to take an exam before investing. More recently, Singaporean regulators have been working on streamlining the screening process for crypto projects and companies seeking to secure bank accounts in the country. Note that banking access is the most prominent crypto industry issue, so this initiative could be very bullish.

There are just two problems crypto could encounter in Singapore. First, the country experienced direct financial damage when FTX went bankrupt due to the government-owned investment firm Temasek losing around $275M when the exchange went down. This experience has made Singapore skeptical of cryptocurrency exchanges in general, and this has apparently been causing issues for Binance and others.

That said, there seems to be more to Singapore's supposedly selective scrutiny of cryptocurrency exchanges and companies. Singapore has been reportedly working closely with the Federal Reserve on a CBDC. It suggests that the country is more geopolitically aligned with the United States and, unlike the other countries, is not trying to escape American influence using a CBDC.

It may explain why Singaporean authorities scrutinized Binance but not FTX, and the country continues to flip-flop between accepting and rejecting crypto. For those who don't know, Binance has been facing much scrutiny from US regulators as of late, as has the rest of the crypto industry, which means that Singapore's impact on the crypto market could go either way.

It could be very positive if the country decides to compete with its neighbors on crypto regulations, but it could be very negative if it chooses to follow in the footsteps of the US. In all probability, Singapore will walk a very fine line. In any case, it's clear that the demand for crypto from elite investors in Singapore is very high. Once the country has finalized its crypto regulations, the inflows could be comparable to those from Hong Kong. The difference is that no crypto niches will be off-limits; Singapore will invest in everything.

Image source: BeinCrypto

Last on the list of countries to watch is France. Some say France is a wild card, but it’s becoming the most crypto-friendly country in Europe, outside of Switzerland, and possibly the most crypto-friendly country in the West. It appears to be because of President Emmanuel Macron. Since Macron was re-elected in April last year, there has been an avalanche of pro-crypto news coming out of France.

For starters, Binance secured a digital asset registration in the country in May 2022. This move was significant because Binance has faced much scrutiny elsewhere in Europe. Last September, one of France's largest banks began offering crypto custody services to institutional investors and subsequently secured the same digital asset registration as Binance to provide even more crypto services. It came about when US banks started facing scrutiny for doing the same.

Earlier this year, Binance partnered with a French company to test crypto payments in the country. French Regulators also announced that they would revamp and introduce better crypto regulations. This is noteworthy because the EU is working on its own crypto regulations, and France is front-running. As a cherry on top, USDC stablecoin issuer Circle recently chose France to host its European headquarters. Considering that Circle understands crypto regulations everywhere and has the money to set up anywhere, choosing France confirms that the country is highly pro-crypto.

Notably, one of the only anti-crypto headlines from France was about DeFi from earlier this month. The Bank of France wants DeFi protocols to be certified and incorporated so they can be regulated. The silver lining is the bank wants different regulations for DeFi from TradFi, which is the opposite of what regulators in the United States and its other allies have been calling for. They've been saying that Decentralized Finance should be regulated the same as Traditional Finance. Therefore, France's deviation on crypto policy and other international issues could be evidence of substantial geopolitical changes.

This article about online censorship laws being introduced worldwide highlights that the EU has introduced a set of laws that target US tech companies. It relates to the possibility, if not likely, that the EU's initial pro-crypto regulations were a similar kind of retaliation.

The abridged version is that the US is trying to attract Europe's most prominent industries with significant incentives, particularly the renewable energy industry. These industries are struggling with high energy costs and inflation due to the war in Ukraine, which most know by now, is a proxy war between the US and Russia. Macron is the only European leader willing to protest the precarious position the EU has been put in because of the US's foreign policy.

Case in point, he recently doubled down on his comments that the EU should not get involved in a conflict between the US and China over Taiwan. France’s pro-crypto stance seems to be an extension of this sentiment, and the countries and the continents attempt to retain economic growth in the face of terrible economic fundamentals.

The question is, how long can France maintain this divergent stance? Well, nobody knows the answer but Macron. Something else to consider; France may not be the best place for a crypto Hub: Besides the high taxes and strict employment laws, France will constantly face pressure from other countries in the EU if it goes down this pro-crypto path, which could even result in punishments. Still, if France continues against the grain, it could inspire other countries to do the same, not just in Europe.

French is one of the world's most widely spoken languages. More importantly, it's spoken in many African and Middle Eastern countries actively trying to escape the US dollar. It would be easy for these countries to follow in France's footsteps, which could lead to other unforeseen network effects in both regions. Eventually, every country will realize that crypto adoption is inevitable. The sooner they adopt it, the higher they will be in the new pecking order—Game Theory at its finest.