This Blog Post is now in the queue for publishing as requested.

Depending on transfer load expect completion in around 15 minutes or 60 minutes if it has just been published by the owner.

This Blog Post has been removed from the queue for publishing as requested.

The rising gold price makes investors shine

Posted by

Otto Knotzer on July 15, 2020 - 5:05am

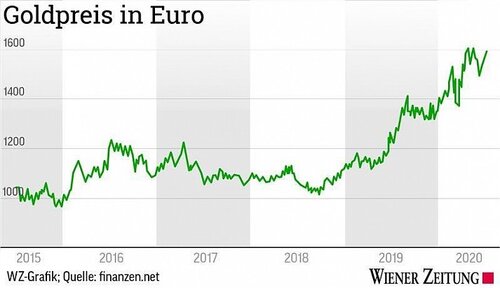

Since the beginning of the year, the value of the yellow precious metal in euros has increased by 17 percent.

More and more investors are stocking up on gold.

Gold price rises above $ 1,800 for the first time since 2011

Gold shines in the crisis

Not everything that glitters is gold - sometimes it is also the eyes of investors: Not only is the gold price in record highs calculated in US dollars, even those who paid in euros can increase their value by 17 percent this year alone looking forward. "In the next decade, we expect a further increase by a factor of 1.8," says Christian Brenner from gold trader Philoro.

Every trader advertises his goods, Brenner says: "Geopolitical uncertainties, the US-China trade war and the low interest rate environment speak for a further increase." The behavior of the central banks is a very good indicator of this, they have bought more gold in the past two years than in the last 50 years, says Brenner.

Anyone who bought gold and paid in euros a year ago can now make a 28 percent profit, the increase in value is around 50 percent over three to five years, and those who joined ten years ago can participate in the current price of around 1595 euros get out of a profit of 68 percent - or he stays on his treasure of gold and hopes for a further price increase.

In the long term, investing in gold is a pretty safe bet - but the risk is in the details, because the price fluctuations are enormous and timing is everything when investing in gold: if you don't have perseverance and can't afford to sit out weaker phases , should maybe stay away from gold.

The global demand for gold is around 4800 tons, Brenner said. Last year, about half of this was used for the manufacture of jewelry and 7 percent for industry. The central banks bought 15 percent, the rest went to investors. "If you look at the numbers from the first half of this year, there is a shift in jewelry from 50 percent to 30 percent." The reason for this is the closure of the jewelry stores due to the Corona crisis.

Online gold sales are growing rapidly

You also felt the crisis yourself, but had no short-time working, but instead switched to home office in some cases, says Brenner. Online sales have increased significantly, on some days up to a thousand parcels have been sent - insured up to a certain value of goods by post, but some have also switched to mail collection.

The Austrian gold and precious metals dealer Philoro was founded in 2011, the founding members were the Brenner and Brückler families. The largest owner today is Christian Brenner's brother Rudolf Brenner, the Constantia holding company holds 40 percent and a good 7 percent of Philoro Holding is co-founder Rene Brückler.

Philoro is currently represented by twelve branches in the DACH region (Germany, Austria, Switzerland). "80 percent of the total demand in Europe comes from this region," says Christian Brenner. "We currently have around 90 employees, the number of part-time employees will be around 100, and we plan to increase to 120 employees by the end of the year."

In the past, gold trading in Austria ran almost entirely through the banks, which sold at a premium of 5 to 6 percent, according to Brenner. Today the banks' market share is significantly lower and their margins have dropped to one to two percent. That is no longer a good business for the banks, but one can live on it as a specialized gold trader: "From the material price of an ounce of gold to the finished coin, the markups are between three and three and a half percent. With bars, even less than one percent."

Anyone buying gold in Austria can do this anonymously up to a value of 10,000 euros and pay in cash. In Germany, the anonymity limit is 2000 euros, in Switzerland 15,000 francs (around 14,094 euros), explains Brenner.