Based on recent data, over ten million ethereum is now secured within liquid staking derivatives platforms, with a valuation close to $20 billion at current exchange rates. Two leading liquid staking decentralized finance (defi) protocols, Lido Finance, and Rocket Pool, experienced 30-day growth rates ranging from 7.57% to 9.69%.

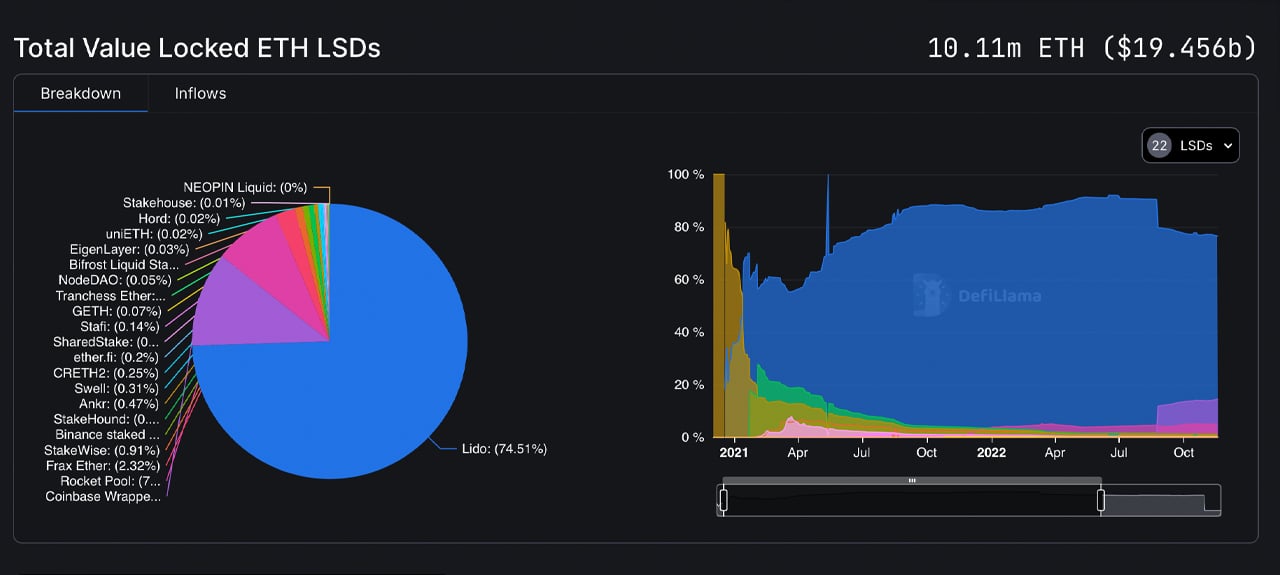

As of July 2, 2023, more than ten million ethereum (ETH) is locked in liquid staking defi platforms. At the time of reporting, approximately 10.11 ETH is locked, with a value of $19.456 billion using today’s exchange rates. Lido, the top-ranking liquid staking derivatives protocol, claims a remarkable 74.51% market share as it holds roughly 7,530,330 ether as of Sunday morning at 8:00 a.m. Eastern Time, according to defillama.com.

The total value locked in Ethereum-based liquid staking derivatives platforms on July 2, 2023, according to defillama.com.

Over the past week, Lido’s total value locked (TVL) rose by 1.90%, while its monthly growth rate reached 7.57%. The defi application’s current TVL stands at $14.43 billion. Meanwhile, Coinbase’s Wrapped Ether defi platform witnessed a seven-day TVL increase of 3.27%, although it experienced a slight dip of 0.24% over the month. Currently, Coinbase’s liquid staking derivatives platform secures around 1,124,130 ether worth $2.24 billion.

Rocket Pool, the third-largest liquid staking protocol, saw a modest seven-day growth of roughly 0.99%. However, its 30-day performance revealed a more substantial increase of 9.69%. On Sunday morning, Rocket Pool’s holdings amounted to around 803,406 ether valued at $1.54 billion. In contrast, the Frax Ether defi application reported a 1.96% weekly rise and a monthly growth of only 0.81%, with control over 234,062 ETH. Lastly, Stakewise, the fifth-largest liquid staking derivatives platform, observed a marginal 0.31% uptick over the past week and a June increase of 1.10%.

Among the 10.11 million staked ether, a total of 22 liquid staking derivatives platforms exist. The top five liquid staking derivatives tokens have an ETH-peg price discrepancy ranging between 0.08% and 0.53%, as recorded on Sunday morning. With Lido’s impressive liquid staking cache, its token Lido staked ether (STETH) now ranks as the seventh largest market cap in the industry today.