Bitcoin, the crypto industry’s largest cryptocurrency, is often called a “digital gold” due to its characteristics of a store of value with a finite supply.

The cryptocurrency’s total supply is limited and pre-defined to just 21 million; as soon as these coins are mined, no more can be created.

Until that cap is reached, however, new coins are created through a process known as mining—a mathematically complex and highly-competitive process of adding and verifying batches (or blocks) of transactions to Bitcoin’s public blockchain.

This scarcity is now even clearer as 18.89 million, or roughly 90% of all coins that will ever exist have now been mined, according to data from Blockchain.com.

It took Bitcoin nearly 13 years to get here after the first block—also known as the Genesis block—was mined by its pseudonymous creator Satoshi Nakamoto on January 9, 2009.

However, mining the remainder of the supply won’t be as quick. Due to Bitcoin’s halving feature, the remaining 2.1 million Bitcoin are expected to be generated by 2140, or in as many as 119 years.

A fundamental pillar of Bitcoin’s deflationary monetary policy, the halving occurs after every 210,000 blocks mined, or approximately every four years, reducing the reward miners receive for their efforts. Each halving event reduces Bitcoin’s issue rate until no more new coins enter into circulation.

Currently, Bitcoin miners receive 6.25 BTC for each block they find, with the reward set to decrease to 3.125 BTC after the next halving.

The next such event, according to data dashboard Clark Moody Bitcoin, is expected to happen in May 2024.

Meanwhile, Bitcoin’s two other key metrics have recently reached new milestones as well, indicating that the network has fully recovered from China’s massive crypto crackdown and the consequent migration of miners to pastures new.

In May, China banned regulated financial institutions from offering crypto-related services such as trading, clearing, and transaction settlement. Later that month, the country effectively started cracking down on Bitcoin mining, which forced major companies to move their operations overseas.

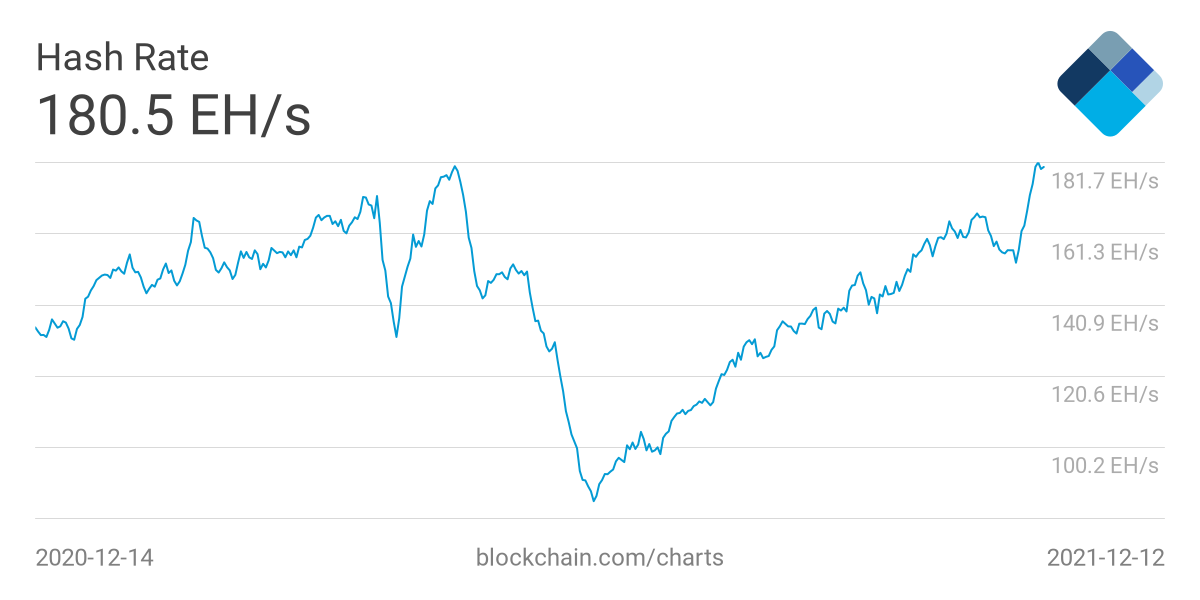

As a result, Bitcoin’s hashrate began to suffer, plummeting to the year-low of 84.79 EH/s in July.

However, the network has steadily recovered, with the hashrate hitting the all-time high of 181.77 EH/s and breaking the previous record of 180.66 EH/s recorded in May this year, per Blockchain.com.

Source: Blockchain.com

Bitcoin mining difficulty—a measure of how difficult it is to mine new coins—also reached a new all-time high of 24.45 trillion the following day, jumping as much as 8.33% since the last readjustment.

According to BTC.com, this is the largest increase since August this year.

Coupled with the rising hashrate, this could indicate that many new mining machines are joining the race, increasing competition between miners.

Despite the strong network fundamentals, the price of Bitcoin failed to consolidate above the $50,000 level it briefly reached last night. The leading cryptocurrency is down 0.8% over the last day, changing hands around $48,840, per CoinGecko.