In brief

Despite continued regulatory pressure from the country’s government and central bank, Indian investors demonstrate increased confidence in cryptocurrencies.

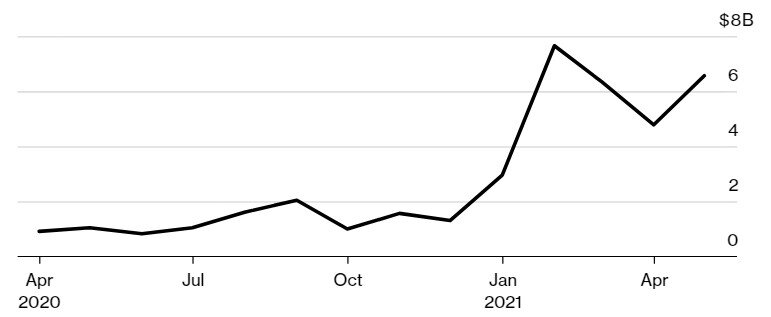

According to data from blockchain forensic firm Chainalysis, crypto investments in India rose over the past year by as much as 19,900%—from $200 million to nearly $40 billion—Bloomberg reported on Monday.

The surge in investment comes despite regulatory uncertainty around the status of crypto in India, with the country's central bank repeatedly threatening to impose a ban on cryptocurrencies. The Reserve Bank of India (RBI) even went so far as to bar local financial institutions from serving crypto companies in April 2018.

Even though last month the RBI backtracked, telling banks that they can ignore a 2018 circular that prohibited them from working with crypto companies, uncertainty remains over India's next steps.

The government has softened its stance somewhat, with the country's finance minister mooting a "window" to allow experimentation with crypto. The government has also convened a panel of experts to consider regulation, arguing that a forthcoming crypto bill will protect investors from volatility.

As Chainalysis's data shows, the authorities' muted enthusiasm for crypto isn't matched by that of local investors, with Indians aged 18 - 35 showing the most appetite for crypto.

Monthly value of fiat invested into crypto by Indians. Source: Chainalysis.

“They find it far easier to invest in crypto than gold because the process is very simple,” Sandeep Goenka, the co-founder of local exchange ZebPay told Bloomberg. “You go online, you can buy crypto, you don’t have to verify it, unlike gold.”

When it comes to profits on Bitcoin investments though, India, according to another Chainalysis report released earlier this month, is lagging behind other markets, ranking 18 out of the top 25 nations at just $241 million.

To put this in perspective, the US topped the list at $4.1 billion followed by China ($1.1 billion), Japan ($900 million), the UK ($800 million) and Russia ($600 million).

According to Chainalysis, this may be a result of the Indian government’s hostility toward the cryptocurrency, as the RBI’s 2018 ruling made it “extremely difficult” for local residents to purchase or trade digital assets.