Startup capital is the initial investment required to launch a business. Entrepreneurs need this capital to cover expenses such as product development, marketing, and operational costs. Sources of startup capital can include personal savings, loans, angel investors, or venture capital. A thorough understanding of startup capital is crucial as it determines the scale and speed at which a business can grow.

Understanding startup capital is fundamental to launching and sustaining a successful business. Startup capital encompasses the initial funds required to turn an entrepreneurial vision into reality. These funds are essential for covering early-stage expenses, such as product development, market research, initial inventory, and establishing a physical or digital presence.

Sources of startup capital can be diverse, including personal savings, family and friends, bank loans, angel investors, venture capital, and crowdfunding platforms. Each source comes with its own set of expectations, risks, and benefits, which entrepreneurs must carefully consider.

For example, venture capital can provide substantial funding and valuable industry connections, but it often requires giving up a significant equity stake and some level of control. Effective management of startup capital also involves strategic planning and forecasting to ensure that the business remains solvent until it becomes profitable.

Ultimately, a thorough understanding of startup capital enables entrepreneurs to navigate the complex financial landscape of starting a business, laying a strong foundation for future growth and success.

Revenue streams are the various sources from which a business earns money. These can include product sales, service fees, subscription models, advertising, and licensing. Identifying and diversifying revenue streams helps entrepreneurs stabilize income and mitigate risks associated with dependency on a single source.

Revenue streams are the lifeblood of any business, representing the various ways through which a company earns income. Identifying and diversifying these streams is crucial for financial stability and growth. Common revenue streams include direct sales of products or services, subscription fees, advertising revenue, licensing deals, and affiliate marketing.

Each revenue stream has its own dynamics and implications for the business model. For instance, a subscription-based model provides predictable, recurring revenue but requires sustained customer satisfaction and retention efforts. Meanwhile, licensing can offer high margins with minimal overhead but may involve significant upfront legal and negotiation costs.

Entrepreneurs must continuously evaluate and optimize their revenue streams to ensure they align with market demand and business goals. Diversifying revenue streams can also mitigate risks associated with market fluctuations, economic downturns, or shifts in consumer behavior, thereby creating a more resilient and adaptable business.

Profit margins represent the difference between revenue and costs. High profit margins indicate that a business is effectively managing its expenses relative to its earnings. Entrepreneurs must continuously analyze and improve profit margins by reducing costs, increasing prices, or enhancing the value of their offerings.

Profit margins are a key indicator of a business's financial health, reflecting the percentage of revenue that exceeds the cost of goods sold (COGS) and other expenses. High profit margins suggest efficient cost management and pricing strategies, while low margins may indicate potential issues with expenses or pricing.

Entrepreneurs must regularly analyze their profit margins to identify areas for improvement, such as reducing production costs, negotiating better terms with suppliers, or optimizing pricing strategies. Understanding the different types of profit margins—gross, operating, and net—helps entrepreneurs gain a comprehensive view of their financial performance at various levels.

For instance, gross profit margin focuses on the core profitability of the product or service, while net profit margin accounts for all expenses, providing a clearer picture of overall profitability. By maintaining healthy profit margins, entrepreneurs can ensure that their businesses remain competitive, financially sustainable, and attractive to investors. Effective management of profit margins also allows for reinvestment into the business, fostering growth and long-term success.

Cash flow is the movement of money in and out of a business. Positive cash flow ensures that a business can meet its obligations, such as paying suppliers, employees, and other operational costs. Entrepreneurs need to monitor cash flow closely to avoid liquidity issues that can jeopardize the business’s operations.

Cash flow management is vital for ensuring the day-to-day operations and long-term sustainability of a business. It involves tracking the inflow and outflow of cash to ensure that the company can meet its financial obligations, such as paying suppliers, employees, and rent. Positive cash flow indicates that a business can cover its expenses and invest in growth opportunities, whereas negative cash flow can signal potential liquidity issues.

Entrepreneurs must develop effective cash flow management strategies, such as timely invoicing, maintaining cash reserves, and negotiating favorable payment terms with suppliers and customers. Regular cash flow forecasting allows businesses to anticipate potential shortfalls and plan accordingly, ensuring that they can navigate periods of low revenue or unexpected expenses.

Maintaining a balance between accounts receivable and accounts payable is crucial to prevent cash crunches. Good cash flow management not only supports smooth business operations but also enhances a company’s ability to seize new opportunities and respond to market changes swiftly.

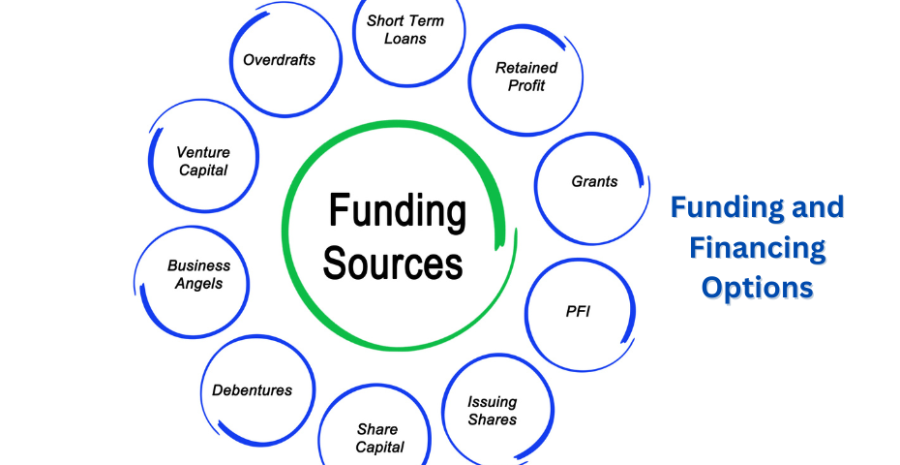

Various funding and financing options are available to entrepreneurs, including bank loans, lines of credit, venture capital, angel investors, and crowdfunding. Each option has its advantages and disadvantages, and understanding these can help entrepreneurs choose the best method to support their business growth.

Understanding funding and financing options is crucial for entrepreneurs looking to grow their businesses. These options range from traditional bank loans and lines of credit to modern methods like crowdfunding and venture capital. Bank loans typically require a solid business plan and collateral but offer predictable repayment terms.

Venture capital, on the other hand, provides substantial funding and valuable industry connections but often requires giving up a significant equity stake and control. Angel investors can be a middle ground, offering capital in exchange for equity with more flexible terms. Crowdfunding platforms like Kickstarter and Indiegogo allow entrepreneurs to raise small amounts of money from a large number of people, validating the business idea and generating buzz.

Each financing option has its own advantages and risks, and the best choice depends on the business's stage, industry, and growth potential. Diversifying funding sources can provide financial stability and reduce dependence on a single investor or lender, fostering a more resilient business model.

Financial forecasting involves predicting future revenue, expenses, and profitability. Budgeting, on the other hand, is the process of creating a plan to manage income and expenses. Effective forecasting and budgeting enable entrepreneurs to make informed decisions, allocate resources efficiently, and plan for future growth.

Financial forecasting and budgeting are critical tools for entrepreneurs to plan and manage their business finances effectively. Financial forecasting involves predicting future revenues, expenses, and profits based on historical data, market trends, and business plans.

This forward-looking approach helps entrepreneurs anticipate financial needs, identify potential challenges, and set realistic goals. Budgeting, on the other hand, involves creating a detailed plan to allocate resources efficiently, ensuring that spending aligns with the business’s financial objectives. By regularly comparing actual performance against forecasts and budgets, entrepreneurs can make informed adjustments to their strategies.

Effective forecasting and budgeting provide a roadmap for achieving profitability and sustainable growth. They also enhance the ability to secure funding, as investors and lenders are more likely to support businesses with well-defined financial plans. Additionally, these practices enable entrepreneurs to make proactive decisions, such as scaling operations, entering new markets, or cutting costs, thereby improving overall financial health and resilience.

Effective cost management is essential for maintaining profitability. This involves identifying fixed and variable costs, negotiating with suppliers, and finding ways to reduce expenses without compromising on quality. Entrepreneurs should regularly review their cost structures and implement strategies to optimize them.

Effective cost management is essential for maintaining profitability and ensuring long-term business success. It involves identifying, analyzing, and controlling expenses to maximize efficiency without compromising quality.

Entrepreneurs must regularly review their cost structures to pinpoint areas where savings can be achieved, such as through better supplier negotiations, process optimization, or adopting cost-effective technologies. Fixed costs, like rent and salaries, need careful management to ensure they do not disproportionately impact the business during lean periods.

Variable costs, which fluctuate with production levels, should be closely monitored to align with revenue changes. Implementing cost control measures, like budgeting and financial analysis tools, helps in maintaining transparency and accountability. Additionally, fostering a cost-conscious culture among employees can lead to innovative ways to reduce expenses. Effective cost management not only improves profit margins but also provides the flexibility to invest in growth opportunities, making the business more competitive and resilient.

Reinvesting profits back into the business is crucial for growth. Entrepreneurs need to allocate funds towards areas that will drive expansion, such as research and development, marketing, and talent acquisition. Strategic investments can help a business scale and achieve long-term success.

Investing in growth is crucial for the long-term success and sustainability of a business. Entrepreneurs must allocate funds strategically to areas that will drive expansion, such as research and development, marketing, and talent acquisition. Investing in research and development can lead to innovative products and services, keeping the business competitive and meeting evolving market demands.

Marketing investments enhance brand visibility and customer acquisition, driving revenue growth. Hiring skilled talent brings fresh perspectives and expertise, fostering innovation and improving operational efficiency. Additionally, investing in technology and infrastructure can streamline processes and reduce costs, positioning the business for scalable growth.

However, these investments require careful planning and analysis to ensure they provide a good return on investment (ROI). By continuously reinvesting profits into growth initiatives, entrepreneurs can build a strong foundation for their business, ensuring it remains agile and competitive in a dynamic market environment. This proactive approach not only fuels immediate growth but also sets the stage for long-term success and sustainability.

Understanding taxation and compliance is vital for avoiding legal issues and maximizing tax benefits. Entrepreneurs should be aware of their tax obligations, including income tax, sales tax, and payroll tax. Working with a qualified accountant can ensure compliance and help optimize tax strategies.

As an entrepreneur, understanding taxation and compliance is crucial for the success of your business. Failure to comply with tax laws can result in severe penalties and fines, which can put your business at risk of financial ruin. It's essential to stay up-to-date on tax changes and regulations to avoid costly mistakes.

A good accountant or tax professional can help you navigate the complex world of taxation and ensure you're in compliance with all applicable laws. They can also help you take advantage of deductions and credits that can reduce your tax liability. By staying on top of taxation and compliance, you can focus on growing your business and achieving your goals.

An exit strategy outlines how an entrepreneur plans to sell their ownership in the business and realize their investment. Common exit strategies include mergers and acquisitions, selling to a private equity firm, or going public through an initial public offering (IPO). Planning an exit strategy helps entrepreneurs prepare for the future and maximize the return on their investment.

As an entrepreneur, creating an exit strategy is crucial to ensuring a successful business outcome. An exit strategy outlines the plan for transitioning out of your business, whether it's through a sale, merger, or liquidation. A well-planned exit strategy can maximize your return on investment and provide a sense of security and accomplishment.

It's essential to consider factors such as market conditions, financial performance, and industry trends when developing your exit strategy. A successful exit strategy can also help mitigate risks and ensure a smooth transition for employees and stakeholders.

By planning ahead, entrepreneurs can avoid common pitfalls and create a clear path forward for their business. With a solid exit strategy in place, entrepreneurs can focus on growth and scaling their business with confidence.

Understanding how money works is crucial for entrepreneurial success. From securing startup capital to managing cash flow, each financial aspect plays a vital role in the business's sustainability and growth.

By mastering these financial fundamentals, entrepreneurs can build robust, scalable businesses and achieve their long-term goals.

(6).jpg)

About: Andries vanTonder (65)

45 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me: Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.