- Cryptocurrencies have become fairly popular in the market since they were first introduced in the early 2000s.

- Bitcoin reached historic highs, nearing $20,000 valuation in December 2017 before crashing the following month.

- Cryptocurrency critics say the market is doomed mainly because of a lack of acceptance, the denial of applications for crypto-ETFs, and the future of regulation in the market.

- Proponents contend that these currencies are gaining more momentum in the mainstream market, and are moving toward becoming a standard for payments and value exchanges in different industries.

-

2018 has been rough for cryptocurrencies as the total market shrank from near $800 billion in January to $199 billion at the time of writing. Bitcoin (BTC) $8221.35 -0.01% has lost around 60 percent of its total value, while Ether, the second largest cryptocurrency, is down with around 80 percent.

-

Argument for Cryptocurrencies

-

Cryptocurrencies, and blockchain in general, are starting to garner more mainstream adoption. While merchants remain wary of digital currencies, banks, major tech firms, and other corporations have already started employing them.

-

“Cryptocurrency is nowhere near dead," according to Ceek VR CEO and founder Mary Spio. "It’s just scratching the tip of the iceberg toward mainstream adoption, when companies offer purposeful real life value and integration of cryptocurrencies, we will begin to see the next wave and resurgence of cryptocurrency. It’s all about creating more natural demand and less speculation and hype.” Indeed, it seems many of the cryptocurrencies that have faded were those based on hype and little else.

However, Mohamed El-Erian, chief economic advisor of Allianz, holds that cryptocurrencies and their underlying technology are far from being dead. Instead, he sees more widespread adoption coming from both the public and the private sectors.

-

“Even though 2018 has seen a downturn in the market following the bull run in 2017, we are convinced that the future holds a rebound, driven by institutional capital flowing into crypto assets. Within crypto assets, the wealth distribution will shift away from utility tokens towards Bitcoin and likely security tokens,” said Agada Nameri from iCapital, an iAngels subsidiary dedicated to blockchain opportunities.

While many have shot down the idea that bitcoin and the crypto market are mainstream, the sector is determined to prove them wrong. While cryptocurrencies may still not be a standard for payments and value exchanges, the technology that underlies them—blockchain—is quickly becoming a standard in different sectors and industries. Perhaps more crucially, the services these tools provide are all based on, and powered by, cryptocurrencies and tokens. As companies continue to fix pain points and uncover new frictionless solutions to old problems with blockchain, crypto will flex its muscles even further.

The Bottom Line

Despite its many doubters and doomsayers, the crypto market has continued to plug along and thrive. Although prices have fluctuated wildly—and in some cases enormously to the downside—the sector is finally starting to stabilize and increasingly appears to be leaving its infancy behind.

As more companies discover uses for crypto and blockchain, and more users accept them as a way to simplify their lives, they will remain a central point of conversation in technology. More interestingly, as it better demonstrates its value in a variety of situations—from banking to buying coffee—the technology will further ingrain itself. Coins may come and go, and many cryptocurrencies are indeed likely to fail, but the sector will continue to forge ahead unabated.

-

-

Although Bitcoin, the king of cryptocurrencies, is seen as volatile in its price action, it could be considered as an evolution into a sovereign financial global status. As more people understand that Bitcoin and its ecosystem are exponential technology, this scarce, deflationary, immutable, trustless, geopolitically neutral payment network is the most prominent financial innovation of a lifetime.

-

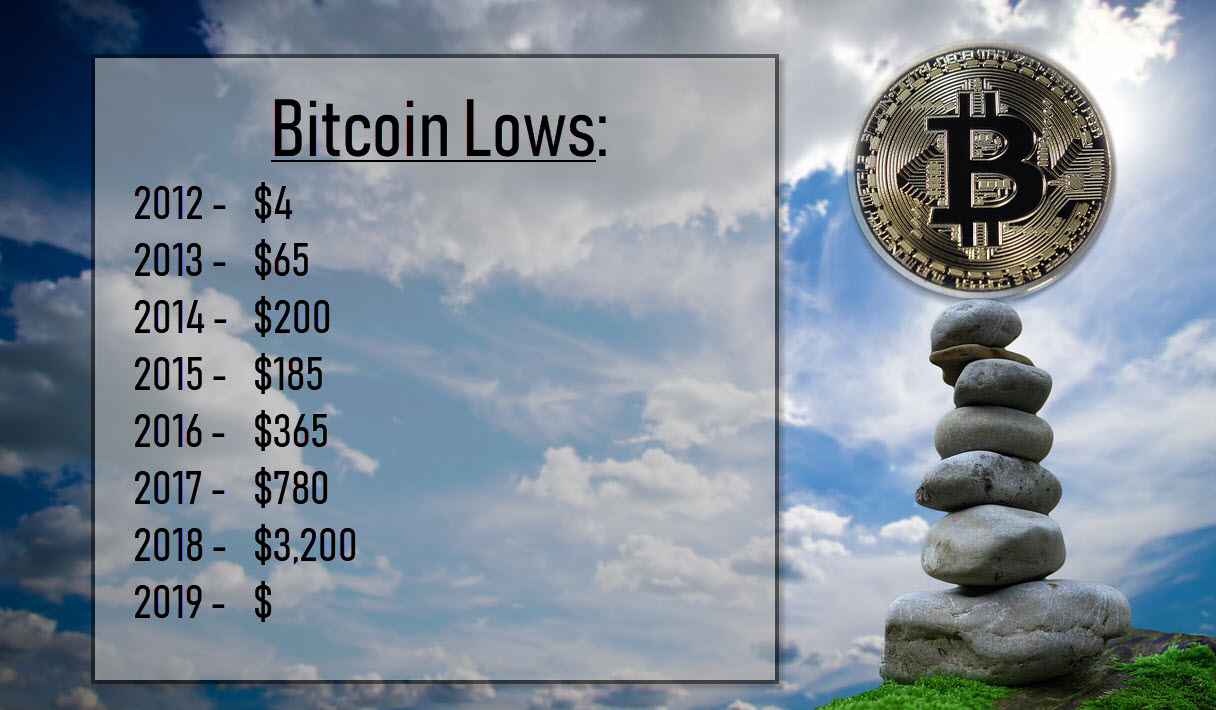

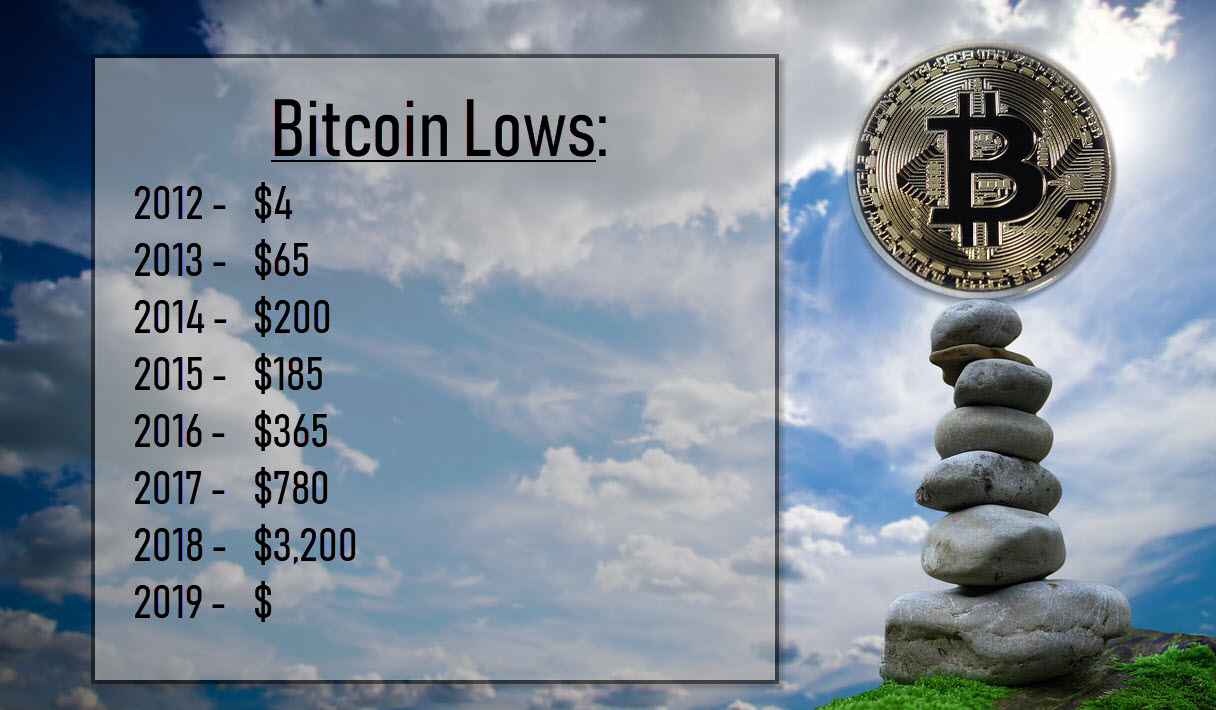

According to one respected analyst now stating that Bitcoin’s forthcoming halving event could compel Bitcoin towards and even surpass its previously established all-time highs. Historically Bitcoin’s halving has lead to 100% + gains and as PlanB, a popular cryptocurrency analyst explains in a recent tweet, at the time of 2012 halving when BTC was at $5, it rose to $12, which is a gain of 140%. Likewise with the 2016 Bitcoin halving which led its price from $314 to $627 which is close to a 100% surge.

By the time of the next halving which is in 9 months and assuming that history repeats itself, it’s a real possibility and fair to assume the 2020 halving will lead to a price surge of a corresponding volume. This means given the current price of $8221.35, BTC could well be trading anywhere between $20,200 and $24,240 in nine months' time.

MarketHive - The Ecosystem for Entrepreneurs.

Free: Register now and get USD$104 in 500 MHV coins -- Already listed on public coin exchange -- Value increasing consistently PLUS $2,000 + Per Month System FOR FREE!!

Go here : http://markethive.onlyforwinners.net/