By Tim Hakki

.png)

Layer 1 blockchains took a beating this week, with several major networks down double-digits over the last seven days, including Solana, Cosmos, Polkadot, and NEAR Protocol.

Each of these networks purports to improve on the shortcomings of more popular crypto networks by improving either throughput, security, or decentralization.

Solana is the eighth-largest crypto with a market cap of roughly $29.5 billion, according to CoinMarketCap. The network can reportedly process 65,000 transactions per second (TPS) – significantly higher than the world's second-largest cryptocurrency, Ethereum, which handles 15 TPS.

Over the last seven days, Solana dropped by more than 20% and trades for $92.77 at writing.

At 1,000 TPS, Polkadot is about 65 times slower than Solana but still faster than Ethereum. Still, Polkadot took a 17% hit this week and now trades at $18.2.

The Cosmos network of blockchains is ten times faster than Polkadot, but speed couldn't save the native ATOM token from a nearly 19% crash this week. It trades at $25.89 at the time of writing.

But proof-of-stake (PoS) blockchain NEAR Protocol is easily the Usain Bolt of cryptocurrencies, managing an eye-watering 100,000 TPS. Unfortunately, it too fell 23% this week to $10.29.

However, the poor performance of these alternative networks hasn't spilled over to the leading cryptocurrencies. Bitcoin is down a little over 1% over the last week, trading at $42,094.49, while Ethereum is down 6% to $2,867.

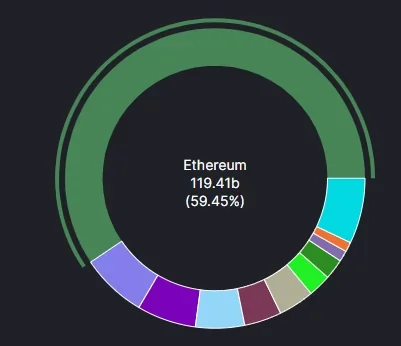

Ethereum's market share within the world of decentralized finance (DeFi) also remains mostly unchallenged. Like other layer 1 network's in its cohort, developers have been building various applications, including decentralized exchanges (DEXs) and money markets, atop the Ethereum network for some time.

That head start now gives Ethereum a whopping 59% of the entire $119 billion DeFi market, according to data provided by DeFi Llama.

After that, Terra, Binance Smart Chain (BSC), Avalanche, and Fantom make up the rest of DeFi's top 5 largest DeFi ecosystems.

Ethereum market share of DeFi. Source: DeFi Llama.

Whatever market forces triggered Layer-1 selloffs this week, the two market leaders remained mostly unaffected.

THE VIEWS AND OPINIONS EXPRESSED BY THE AUTHOR ARE FOR INFORMATIONAL PURPOSES ONLY AND DO NOT CONSTITUTE FINANCIAL, INVESTMENT, OR OTHER ADVICE.