A crypto asset is a digital representation of value that is not issued by a central bank, but is traded, transferred and stored electronically by natural and legal persons for the purpose of payment, investment and other forms of utility, and applies cryptography techniques in the underlying technology.

According to the Explanatory Memorandum on the Taxation Laws Amendment Bill as issued on 20 January 2021 the word “cryptocurrency” was replaced with “crypto asset” in line with the proposed adoption of a uniform definition of crypto assets within the South African regulatory framework.

The process to understand and document crypto assets in South Africa started in 2014:

Yes, normal income tax rules apply to crypto assets and affected taxpayers need to declare crypto assets’ gains or losses as part of their taxable income.

The onus is on taxpayers to declare all crypto assets-related taxable income in the tax year in which it is received or accrued. Failure to do so could result in interest and penalties.

Following normal income tax rules, income received or accrued from crypto assets transactions can be taxed on revenue account under “gross income”.

Alternatively such gains may be regarded as capital in nature, as spelt out in the Eighth Schedule to the Act for taxation under the Capital Gains Tax (CGT) paradigm. Determination of whether an accrual or receipt is revenue or capital in nature is tested under existing jurisprudence (of which there is no shortage).

Taxpayers are also entitled to claim expenses associated with crypto assets accruals or receipts, provided such expenditure is incurred in the production of the taxpayer’s income and for purposes of trade.

Base cost adjustments can also be made if falling within the CGT paradigm. Gains or losses in relation to crypto assets can broadly be categorised with reference to three types of scenarios, each of which potentially gives rise to distinct tax consequences:

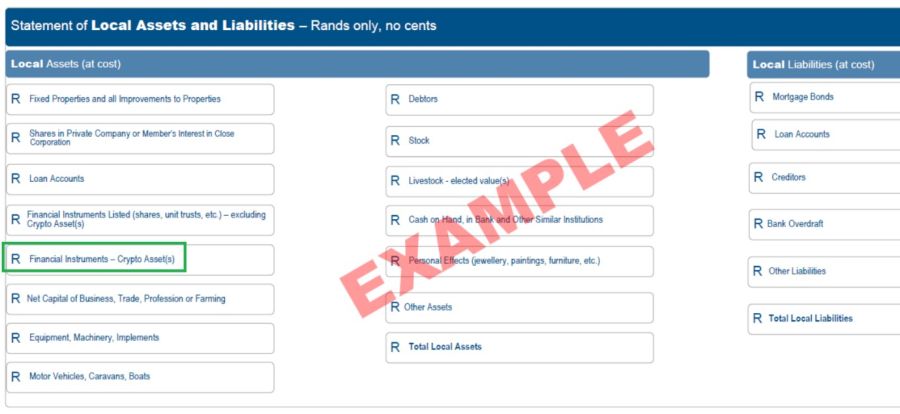

See an example of the Income Tax Return (ITR12) form for the 2020/21 tax year and below print screens where crypto assets are mentioned:

Legislatively, SARS is granted a wide range of collection powers in terms of the Income Tax Act, including a requirement for third-party service providers to submit financial data.

Enforcement and audit processes are confidential and not shared with members of the public.

Last Updated:

Let your startup be the exception, not the statistic.

....................................................................................................................................................................................................

About: Andries vanTonder

Over 46 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me: Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.