By Stephen Graves and Daniel Phillips

In brief

For many years, the idea that publicly traded corporations might buy Bitcoin for their reserves was considered laughable. The top cryptocurrency was considered too volatile, too fringe to be embraced by any serious business.

Over the past year and a half, fueled by the economic effects of the COVID-19 pandemic, that taboo has been well and truly broken, with a number of major institutional investors buying up Bitcoin. The floodgates first opened when cloud software company MicroStrategy bought $425 million worth of Bitcoin in August and September 2020. Others followed suit, including payments processor Square and EV manufacturer Tesla.

For investors unwilling to buy Bitcoin themselves, buying shares in public companies that hold Bitcoin can be a way of gaining exposure to the asset without the hassle of arranging self-custody. Indeed, some experts think that the extent of MicroStrategy's Bitcoin purchases have made the company a de facto Bitcoin ETF.

1.

MicroStrategy

MicroStrategy, a prominent business analytics platform, has adopted Bitcoin as its primary reserve asset.

Throughout 2021, the firm—which produces mobile software and cloud-based services—continued its Bitcoin buying spree. As of December 2021, it holds 124,391 BTC in reserve, equivalent to over $5.8 billion in BTC. At one point, MicroStrategy CEO Michael Saylor said, he was buying $1,000 in Bitcoin every second.

Unlike other CEOs who typically shy away from discussing their personal investments, Saylor has made it public that he personally holds 17,732 BTC—currently worth over $832 million.

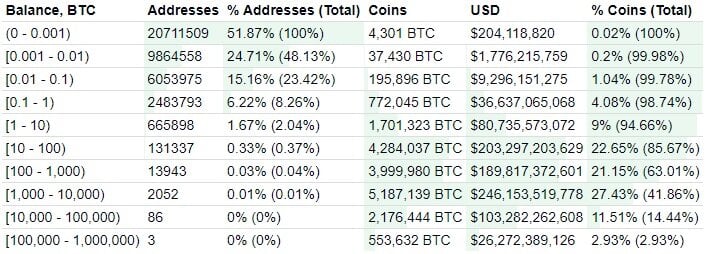

As per data from BitInfoCharts, this positions Saylor among the top 100 Bitcoin owners—assuming it is all held within a single address. It’s something of an about-face for the MicroStrategy CEO, who in 2013 claimed that Bitcoin’s days were numbered.

Bitcoin distribution by number of addresses. Image: BitInfoCharts

On New Year's Eve, 2020, Morgan Stanley revealed that it had purchased 10.9% of MicroStrategy. And MicroStrategy is looking to get other companies invested in Bitcoin; in February 2021, it hosted a Bitcoin for Corporations strand during its World.Now conference, aimed at getting companies up to speed with the crypto asset.

During the conference, Saylor stated that he anticipated an "avalanche of companies" converting their balance sheets into Bitcoin in the coming year.

Speaking at Binance Blockchain Week, Saylor explained why he'd opted for Bitcoin over gold as a reserve asset. "The returns on gold didn’t look nearly as compelling as Bitcoin," said Saylor, adding, "if you’re looking for a non-fiat derivatives store of value in an inflationary environment, that’s logical that you would settle upon Bitcoin as digital gold."

2.

Tesla

A Tesla Cybertruck. Image: Tesla

Electric vehicle manufacturer Tesla has joined the ranks of companies holding Bitcoin, with an SEC filing revealing that the company invested "an aggregate $1.50 billion" in the cryptocurrency; the company's 42,902 BTC are currently worth $2.04 billion.

Tesla sold 10% of its Bitcoin holdings in Q1 2021; according to CEO Elon Musk, this was "to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet."

According to its SEC filing, Tesla's Bitcoin purchase reflects an updated investment policy aimed at diversifying its cash on hand and maximizing returns. The filing states that, "we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future."

The company's Bitcoin play followed months of speculation, as CEO Elon Musk took to Twitter to discuss the cryptocurrency. In late 2020, MicroStrategy's Saylor offered to share his "playbook" for Bitcoin investing with Musk, after arguing that a move into Bitcoin would be doing Tesla shareholders a "$100 billion favor."

Soon afterwards, at the end of January 2021, Musk changed his Twitter bio to the #Bitcoin hashtag; in retrospect, seemingly hinting at Tesla's interest in the cryptocurrency.

However, Musk's relationship with Bitcoin isn't completely positive. After announcing that Tesla would accept payments in Bitcoin for its products and services in March 2021, just two months later the CEO abruptly announced that the company would no longer accept the cryptocurrency for payments.

Citing the "rapidly increasing use of fossil fuels for Bitcoin mining and transactions", Musk revealed that the company wouldn't be selling any of its Bitcoin holdings, and would consider using it for transactions again once mining "transitions to more sustainable energy." He later clarified that the company would resume using Bitcoin for transactions once miners are using 50% clean energy.

Musk, who's emerged as a keen advocate of Dogecoin over the course of 2021, has announced that Tesla will enable Dogecoin purchases for some Tesla merchandise.

3.

Galaxy Digital Holdings

The largest institutional holder of Bitcoin to be directly involved with the crypto industry, crypto-focused merchant bank Galaxy Digital Holdings holds 16,400 BTC, according to bitcointreasuries.org—worth just over $779 million at current prices.

Founded by Michael Novogratz in January 2018, the company has partnered with crypto firms including Block.one and BlockFi. Novogratz is, unsurprisingly, a keen advocate for Bitcoin. In April 2020, he noted that stimulus measures announced in response to the coronavirus pandemic were driving interest in cryptocurrencies, calling it Bitcoin's "moment" and arguing that "money doesn't grow on trees."

However, later in the year, Novogratz argued that the cryptocurrency's volatility meant that gold was a safer bet, stating that, "My sense is that Bitcoin way outperforms gold, but I would tell people to hold a lot less than they do gold. Just because of the volatility." In September 2021, Galaxy Digital launched a joint proposal for a spot Bitcoin ETF; to date, the U.S. Securities and Exchange Commission has only approved Bitcoin futures ETFs.

4.

Voyager Digital LTD

Crypto brokerage Voyager Digital holds 12,260 BTC according to bitcointreasuries.org, worth around $582 million at current prices. The firm aims to provide a one-stop shop for trading digital assets, and in May 2021 reported quarterly revenue of $60.4 million, up 16x from the previous quarter. "We saw exponential adoption of cryptocurrencies as a recognized and investable asset class," said CEO Steven Ehrlich at the time.

In its June 2021 filing with Canadian regulators, the company strikes a more measured tone, noting that, "a significant drop in bitcoin price may have a material adverse effect on the Company’s results of operations," and pointing to the "drastic drop" in the price of Bitcoin in March 2020 as a result of market uncertainty around the coronavirus pandemic.

5.

Block, Inc.

Alongside Tesla, Block (formerly known as Square), lit the fuse for institutional investment in Bitcoin with its October 2020 investment of $50 million in the cryptocurrency.

Since then, the payments company has continued to invest in Bitcoin, revealing that it had scooped up another $170 million worth in its Q4 2020 earnings statement. It was, perhaps, unsurprising, considering that CEO Jack Dorsey is an enthusiastic advocate for Bitcoin (even running his own Bitcoin node).

At the time, the company described the investment as "part of Square’s ongoing commitment to bitcoin," noting that "the company plans to assess its aggregate investment in bitcoin relative to its other investments on an ongoing basis."

With its holdings now amounting to 8,207 BTC, worth $381 million at current prices, Block hasn't changed its tune on Bitcoin. In March 2021, the company's CFO Amrita Ahuja argued that, "There's absolutely a case for every balance sheet to have Bitcoin on it," in an interview with Fortune, while reaffirming the company's commitment to holding the cryptoasset "for the long term."

In May 2021, the company reaffirmed its commitment to its Bitcoin buying strategy, following an interview in which Ahuja had said the company had no plans to make further Bitcoin purchases. Block has also made further efforts to build out the Bitcoin ecosystem, launching a $5 million fund to further crypto education and leaping to Bitcoin's defense with a white paper defending the cryptocurrency's environmental impact.

The company is also getting involved with Bitcoin technology, announcing plans to plans to develop a Bitcoin hardware wallet in July 2021, while in October 2021, Dorsey tweeted that the company was considering building Bitcoin mining rigs.

The company changed its name from Square to Block in December 2021, in an apparent reference to the blockchain technology that underpins Bitcoin. The rebrand followed Dorsey's announcement a week earlier that he was stepping down as Twitter CEO to focus on the payments company.

6.

Marathon Digital Holdings Inc.

Bitcoin mining company Marathon Digital, unsurprisingly, is also a large holder of Bitcoin, with 7,649 BTC in its corporate treasury (worth around $363 million at current prices). The company, which aims to build "the largest Bitcoin mining operation in North America at one of the lowest energy costs," originated as a patent holding firm (and was often referred to as a patent troll) before its pivot into crypto mining.

The company's had a good 2021, kicking off the year with a $200 million capital raise before rounding out January with a $150 million Bitcoin purchase. Over the last year, its stock price has surged by over 3,000%, boosted by the exodus of crypto miners from China (indeed, it's outperformed Bitcoin over the year to date).

Marathon Digital eventually aims to have over 199,000 Bitcoin miners churning out 23.3 EH/s a day by 2023, a 600% increase from its December 2021 hash rate. That month, the company placed a mammoth order of 78,000 Antminer mining machines from Bitmain, to be delivered throughout 2022.

7.

Hut 8 Mining Corp

Canadian crypto mining firm Hut 8 holds 5,242 BTC, worth $249 million, according to bitcointreasuries.org. In June 2021, the company listed on the Nasdaq Global Select Market under the HUT ticker, with the company's SEC filing noting that it's "committed to growing shareholder value by increasing the number and value of our bitcoin holdings".

The company also explained that it generates fiat income by leveraging its reserve of self-mined and held Bitcoin, "via yield account arrangements with leading digital asset prime brokerages".

In June 2021, Hut 8 shared its ambitious goal of mining 5,000 BTC by the end of the year; with the company snapping up new mining machines and China's crackdown reducing Bitcoin's mining difficulty, unsurprisingly the company's optimistic that the "favorable geopolitical environment" will benefit its mining operations in 2021.

8.

Coinbase Global, Inc.

Arguably the best-known crypto firm in this list, crypto exchange Coinbase went public in a direct listing on the Nasdaq in April 2021.

The move was hailed as a landmark for the crypto industry, though that hasn't been borne out by Coinbase's declining stock price; having debuted at $381, COIN ended the year at around $250.

Ahead of its listing, in February 2021, Coinbase revealed that it held $230 million in Bitcoin on its balance sheet; by December 2021, its Bitcoin holdings had slipped to $213 million (4,482 BTC).

9.

Riot Blockchain, Inc.

Another crypto mining outfit, US-based Riot Blockchain holds 3,995 BTC, worth $189 million at today's prices.

With its valuation surging from below $200 million in 2020 to highs of over $6 billion in 2021, the Nasdaq-listed company has been on an aggressive expansion drive of late. In April 2021, it spent $650 million on a one-gigawatt Bitcoin mining facility in Rockdale, Texas; describing the purchase as a "transformative event" that would make the company the "largest publicly-traded Bitcoin mining and hosting company in North America, as measured by total developed capacity."

Nevertheless, Riot's share price has declined since hitting its all-time high in of February 2021; at the time of the Rockdale purchase, it was trading at $48 a share; by the end of the year it had slipped to around $23 a share, a drop of 52%.

10.

Bitcoin Group SE

Germany-based venture capital firm Bitcoin Group SE brings up the rear of the list, with relatively modest holdings of 3,947 BTC, worth $187 million at today's prices. Its investments include crypto exchange Bitcoin.de and Futurum bank, which merged in October 2020 to form "Germany's first crypto bank".

The move followed the German parliament's decision to enable banks to sell and store cryptocurrencies, with Bitcoin Group SE managing director Marco Bodewein highlighting the opportunity to introduce the bank's institutional investors to crypto's "high returns and safety features."