In brief

In the last few months, reports that major institutional investors are scooping up Bitcoin (BTC) in droves have added fire to what can now be considered the biggest crypto bull run since 2017.

Several major firms have collectively purchased hundreds of millions of dollars worth of Bitcoin, while retail interest in Bitcoin has also skyrocketed—sending the price of BTC to a new all-time high.

As Bitcoin continues its meteoric growth, we take a look at the companies who are stockpiling the cryptocurrency—both on behalf of investors as funds, and as a reserve asset.

These publicly-traded firms have adopted Bitcoin as a reserve asset, and hold direct control over their Bitcoin funds.

MicroStrategy, a prominent business analytics platform, has adopted Bitcoin as its primary reserve asset.

In December 2020, the firm—which produces mobile software and cloud-based services—capped off a year of Bitcoin buys by scooping up $650 million in BTC. It now holds 70,470 BTC in reserve—equivalent to over $2.4 billion in BTC. At one point, MicroStrategy CEO Michael Saylor said, he was buying $1,000 in Bitcoin every second.

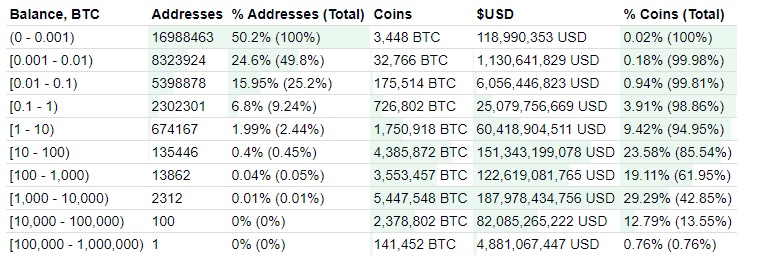

Bitcoin distribution by number of addresses. Image: BitInfoCharts

Unlike other CEOs who typically shy away from discussing their personal investments, Saylor has made it public that he personally holds 17,732 BTC—currently worth over $616 million.

As per data from BitInfoCharts, this positions Saylor among the top 100 Bitcoin owners—assuming it is all held within a single address. It’s something of an about-face for the MicroStrategy CEO, who in 2013 claimed that Bitcoin’s days were numbered.

On New Year's Eve, 2020, Morgan Stanley revealed that it's purchased 10.9% of MicroStrategy. And MicroStrategy is looking to get other companies invested in Bitcoin; in February 2020, it's hosting Bitcoin for Corporations, an online course aimed at getting companies up to speed with the crypto asset.

Galaxy Digital Holdings

Crypto-focused merchant bank Galaxy Digital Holdings holds 16,402 BTC, according to bitcointreasuries.org—worth just over $564 million at current prices.

Founded by Michael Novogratz in January 2018, the company has partnered with crypto firms including Block.one and BlockFi. Novogratz is, unsurprisingly, a keen advocate for Bitcoin. In April 2020, he noted that stimulus measures announced in response to the coronavirus pandemic were driving interest in cryptocurrencies, calling it Bitcoin's "moment" and arguing that "money doesn't grow on trees."

However, later in the year Novogratz argued that the cryptocurrency's volatility meant that gold was a safer bet, stating that, "My sense is that Bitcoin way outperforms gold, but I would tell people to hold a lot less than they do gold. Just because of the volatility."

These investment funds don't hold Bitcoin on their own behalf, instead doing so in order to enable accredited investors to gain exposure to Bitcoin without holding or managing the cryptoasset directly.

Grayscale Investments is undoubtedly one of the biggest names in the Bitcoin space—and for good reason.

Grayscale has by far the largest Bitcoin portfolio of any institutional investment platform, with over $21 billion in BTC currently under management in the Grayscale Bitcoin Trust, which trades under "GBTC". In total, Grayscale Investments now holds more than 2% of the Bitcoin total supply, with 572,644 BTC currently under management according to bitcointreasuries.org.

GBTC Chart by TradingView

Following a short hiatus, Grayscale reopened its Bitcoin Trust to new investors on January 12, 2021. GBTC shares are currently trading on the OTCQX under the ticker GBTC.

Grayscale founder Barry Silbert is (unsurprisingly) an outspoken Bitcoin advocate and can be frequently found on Twitter highlighting its performance. In January 2020, Silbert stepped down from his role as CEO of the company, handing over the reins to former Barclays analyst Michael Sonnenshein.

CoinShares Group, one of the earliest pioneers in digital asset investments, also joins the list of public companies managing substantial Bitcoin assets.

The company is widely regarded as a pioneer in the cryptocurrency investment industry, and was the first firm to launch a regulated Bitcoin hedge fund and exchange-traded Bitcoin product. Nowadays, CoinShares offers two exchange-traded Bitcoin products: Bitcoin Tracker One and Bitcoin Tracker Euro—both of which can be traded on XBT Provider AB.

As of November 2020, CoinShares' assets under management include 69,730 BTC—currently worth just over $2.4 billion. Though not quite as impressive as Grayscale's almost a half a million BTC strong coffers, CoinShares investment still represents over 0.3% of the current Bitcoin circulating supply.

"Investors used to consider it a risk to allocate to Bitcoin. Now it’s a risk not to allocate to Bitcoin," said CoinShares CEO Jean-Marie Mognetti in a recent press release.

London-based asset manager Ruffer Investment Company is one of the most recent firms to join the Bitcoin bandwagon. In December 2020, it allocated 2.5% of its Multi-Strategies Fund to Bitcoin, arguing that the cryptocurrency serves as a "small but potent insurance policy against the continuing devaluation of the world's major currencies."

Ruffer's bet seems to have paid off; its 45,000 BTC, worth around $870 million at the time of purchase, is now worth nearly $1.8 billion.

Canadian crypto-asset portfolio manager 3iQ holds 16,454 BTC, worth just over $566 million, according to bitcointreasuries.org. Following several years of back and forth with regulators, 3iQ's Bitcoin fund was listed on the Toronto Stock Exchange (TSX) in April 2020, enabling Canadians to invest in Bitcoin through their regulated investment managers. The Winklevoss twins’ exchange Gemini acts as custodian for the fund.

In September 2020, the regulated BTC fund was listed on the Gibraltar Stock Exchange. "We expect to co-list this fund around the world in major exchanges,” 3iQ President and CEO Fred Pye told Decrypt. “Our vision is for this to be the biggest regulated Bitcoin fund in the world.”

3iQ is also behind a Canadian dollar-backed stablecoin called QCAD, which launched in February 2020.

Unlike some of Galaxy Digital's funds, such as Galaxy Institutional Bitcoin Fund, its CI Galaxy Bitcoin Fund, launched in November 2020, isn't restricted to institutional firms in America. Instead, the Canadian fund is open for investments from the general public.

The CI Galaxy Bitcoin Fund invests directly in Bitcoin; its holdings are priced using the Bloomberg Galaxy Bitcoin Index, which is designed to measure the performance of a single Bitcoin traded in US dollars. As investors purchased "Class A" and "Class F" units, priced at $10 each, Galaxy Digital allocated to the purchase the equivalent amount in Bitcoin from its own holdings.

It began trading on the Toronto Stock Exchange in December 2020; at the time, Bitcoin was worth just over $19,000, making the fund's 15,750 BTC worth just over $306 million. Today, it's shot up to over $618 million.

Grayscale's Bitcoin Trust isn't the only way for its clients to gain exposure to Bitcoin through its investment vehicles. It also runs the Grayscale Digital Large Cap Fund, an open-ended fund that give investors exposure to a basket of large-cap digital assets.

The fund is currently made up of Bitcoin, Ethereum, Bitcoin Cash and Litecoin, with the lion's share of the fund composed of Bitcoin (81.6% as of January 2021). That Bitcoin amounts to some 7,036 BTC, currently worth nearly $279 million.

That weighting has changed slightly, owing to the removal of XRP from the fund in January 2021, with Grayscale selling all its XRP and topping up the other cryptocurrencies in the fund's basket.