.png)

Roughly every four years, bitcoin rewards paid to miners are cut in half as a way to ensure that an infinite supply of bitcoin doesn’t erode its value further down the line. These events are known as Bitcoin halvings, and each event has historically had a major impact on the price.

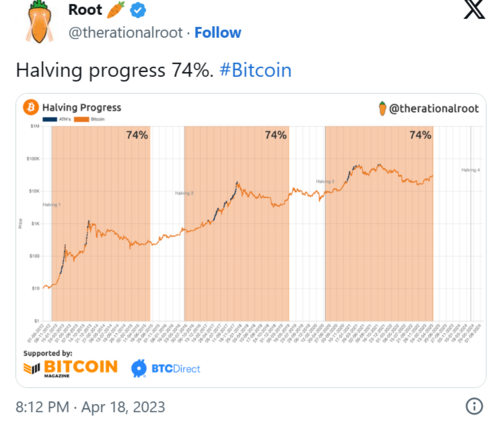

The first halving saw price increases of more than 8,000% from pre-halving levels. Bitcoin’s value also increased roughly 3,000% over the second halving cycle in 2016. The last halving in 2020 was followed by a bull run that ended in an all-time high price of almost $69,000.

Will the fourth halving in April 2024 deliver the same results?

The law of supply and demand dictates that an asset with a limited supply can generally be considered more valuable than if its supply were infinite.

This is true of gold, diamonds, art, and, in theory, some cryptocurrencies as well. There will only ever be 21 million bitcoin in circulation, and no new coins will be minted when this limit is reached in the year 2140.

If demand for bitcoin continues to go up as it has in the past, the limited supply will drive up prices as investors are willing to pay more for remaining coins.

The creator(s) of Bitcoin intimated their political reasons for the creation of the protocol by leaving a clue in the first block mined, a headline from a newspaper article reading, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Could bitcoin’s capped supply be seen as an antidote to government monetary policies that often lead to inflation? Many believe so.

“The purpose of halving is to maintain the scarcity of Bitcoin and prevent inflation,” notes the Blockchain Council. “This scarcity is one of the reasons why Bitcoin is often compared to gold as a store of value.”

JP Morgan said in a recent note that next year’s halving has led to renewed investor interest in the coin. “[The halving] would mechanically double bitcoin’s production cost to around $40,000, creating a positive psychological effect,” the bank noted, explaining that BTC’s production cost has historically acted as an effective lower boundary to its price.

Miners verify one block of transactions on the blockchain every 10 minutes and receive 6.25 BTC as a reward. The halving in 2024 will cut rewards to 3.125.

Market psychology also comes into play. Once the deflationary narrative of the event catches on and more people buy bitcoin, it leads to more demand, which further limits supply. As Bitcoin Magazine writes, “Our primary thesis is that the halving leads to a demand-driven event in bitcoin, as market participants become acutely aware of bitcoin’s absolute digital scarcity.”

In the past it’s taken a while for markets to digest halving events, often seeing a delay of six to 12 months between the event and a notable increase in price.

Below we’ve noted the BTC price at the time of the halving and the peak in the year following the event. These highs were often interrupted by price fluctuations and didn’t necessarily remain at these elevated levels. One certainty is that up until now BTC has never recorded a decrease in value from one halving to the next.

Rewards halved: 50 to 25

Price at halving: $12

BTC high the following year: $1,152

Rewards halved: 25 to 12.5

Price at halving: $650

BTC high the following year: $19,118

Rewards halved: 12.5 to 6.25

Price at halving: $8,500

BTC high the following year: $67,549

Long-term investing is all about patience and discipline. The goal is to invest in companies, funds or cryptocurrencies that have a strong track record of performance and growth.

While bitcoin has seen its share of serious ups and downs since 2009, the price has continued to surge upwards from one halving cycle to the next. Investors and analysts often say that history doesn’t repeat but it rhymes. Historically, the Bitcoin halving has been no exception, will it continue on the same trajectory in the future?

To Invest in Bitcoin, click HERE

Please note that the information below is not intended nor does it constitute financial or investment advice. Before making any decision or taking any action regarding your finances, you should consult a licensed Financial Adviser. The information and content provided below is provided as general information. While every care and effort has been taken to ensure the accuracy of the information provided, we do not guarantee the suitability, accuracy or potential value of any information provided above.

Join Markethive - the only Market Network on Blockchain, click HERE

.png)

About: Andries vanTonder

Over 40 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me at my Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.