The Power of Passive Income: How to Make Your Money Work for You

In today’s fast-paced world, financial stability is a common goal for many. Yet, the traditional 9-to-5 job often limits both time and earning potential. This is where passive income comes in—a game-changing financial strategy that allows you to generate wealth with minimal ongoing effort.

Passive income isn’t just a buzzword; it’s a proven approach to achieving financial freedom, reducing stress, and creating long-term wealth. Imagine earning money while you sleep, travel, or spend time with family. Instead of being tied to a paycheck, you can build streams of revenue that work for you, helping you break free from financial limitations.

Passive income can take many forms, from investments in stocks and real estate to digital products, affiliate marketing, and online businesses. Unlike active income, where you exchange time for money, passive income requires an initial investment of time, effort, or capital but continues to generate returns long after the work is done.

The beauty of passive income lies in its scalability—once set up, it can grow exponentially without requiring proportional increases in effort.

This financial strategy is not just for the wealthy or financially savvy. Anyone can build passive income streams with the right mindset, education, and persistence. Whether you’re looking to supplement your salary, retire early, or achieve complete financial independence, passive income can be a powerful tool to reach your goals.

In this article, we will explore eleven powerful ways to generate passive income and how each method can help you make your money work for you.

One of the simplest ways to build passive income is through dividend stocks. These stocks belong to companies that distribute a portion of their earnings to shareholders in the form of dividends.

The key to success in dividend investing is selecting well-established, financially stable companies with a history of consistent payouts.

Blue-chip stocks, such as those in the S&P 500, often provide reliable dividends that grow over time. By reinvesting these dividends, you can take advantage of compound interest, exponentially increasing your returns.

Real estate has long been a cornerstone of wealth-building. By purchasing rental properties, you can create a steady stream of passive income through monthly rent payments.

Whether investing in single-family homes, multi-unit properties, or vacation rentals, real estate offers the potential for both appreciation and ongoing income.

Property management services can help minimize hands-on involvement, making real estate a true passive income source.

Peer-to-peer (P2P) lending platforms connect investors with borrowers, cutting out traditional financial institutions.

Investors earn passive income through interest payments on the loans they fund.

While there is risk involved, choosing reputable platforms and diversifying loans across multiple borrowers can mitigate potential losses.

With the rise of digital learning, online courses have become a lucrative source of passive income.

Platforms like Udemy, Teachable, and Coursera allow creators to design and sell courses on a wide range of topics.

Once developed, courses require little maintenance while continuing to generate income as new students enroll.

Publishing e-books is another effective passive income strategy.

Whether through Amazon Kindle Direct Publishing (KDP) or other platforms, e-books offer a scalable way to earn royalties.

Writing a high-quality, evergreen book can provide a consistent income stream for years.

Affiliate marketing involves promoting other people’s products and earning a commission on sales made through your referral links.

By building a blog, YouTube channel, or social media presence, you can recommend products and earn commissions with minimal effort.

The key is to choose products relevant to your audience and build trust over time.

Real Estate Investment Trusts (REITs) offer a way to invest in real estate without the responsibilities of property management.

REITs pay dividends to investors from the income generated by their real estate holdings.

This is a hands-off approach to benefiting from real estate’s wealth-building potential.

YouTube offers a fantastic opportunity for passive income through ad revenue, sponsorships, and affiliate marketing.

While building a successful channel requires initial effort, once your videos gain traction, they can continue to earn revenue for years through views and ads.

Dropshipping is an e-commerce model that allows entrepreneurs to sell products without holding inventory.

By setting up an online store and automating order fulfillment through suppliers, you can generate passive income with minimal ongoing work.

Index funds provide a simple, low-cost way to invest in the stock market.

By purchasing shares in an index fund, you gain exposure to a diversified portfolio of stocks.

These funds are managed passively, making them a great long-term investment option that generates passive income through capital appreciation and dividends.

11. Invest in Cryptocurrencies

So be sure to familiarize yourself with the specific cryptocurrency you’re interested in, its underlying technology, use cases, tokenomics and the team behind it.The security of your investment is just as important. Use reputable exchanges and secure crypto wallets to protect against hacks and theft.

Yes, crypto is a good investment today – but only if you understand the risks involved. Much like stocks, real estate, or commodities, crypto assets vary widely. You could invest in an overvalued company struggling to generate positive cash flow and lose money, or you could be an early investor in a startup that eventually surpasses giants like Apple.

Passive income is more than just a financial strategy; it’s a lifestyle shift that allows you to break free from the limitations of traditional employment. By diversifying income sources and leveraging smart investments, you can create a life where money works for you, rather than the other way around.

The journey to building passive income requires patience, persistence, and strategic planning, but the rewards are immense.While some passive income streams require upfront effort and capital, others can be started with minimal investment.

The key is to take action—start small, learn as you go, and continually refine your approach. Whether you choose dividend stocks, real estate, online courses, or affiliate marketing, there is a passive income strategy that can align with your skills and financial goals.

Financial freedom is within reach for anyone willing to embrace the power of passive income. By building multiple income streams, you reduce financial stress, gain more control over your time, and open doors to new opportunities.

The sooner you start, the sooner you can enjoy the benefits of financial independence.

Start today, and let your money work for you!

.....................................................................................................................................................................................

As the world of entrepreneurship continues to evolve, Markethive ( The first Market Network Build on Blockchain) remains a beacon of innovation, offering a secure, transparent, and empowering platform for all who seek to make their mark in the digital world.

MarketHive is an entrepreneurial social marketing platform with the combined strength of LinkedIn, Amazon, Facebook and Marketo. It delivers a complete ecosystem all built within the blockchain.

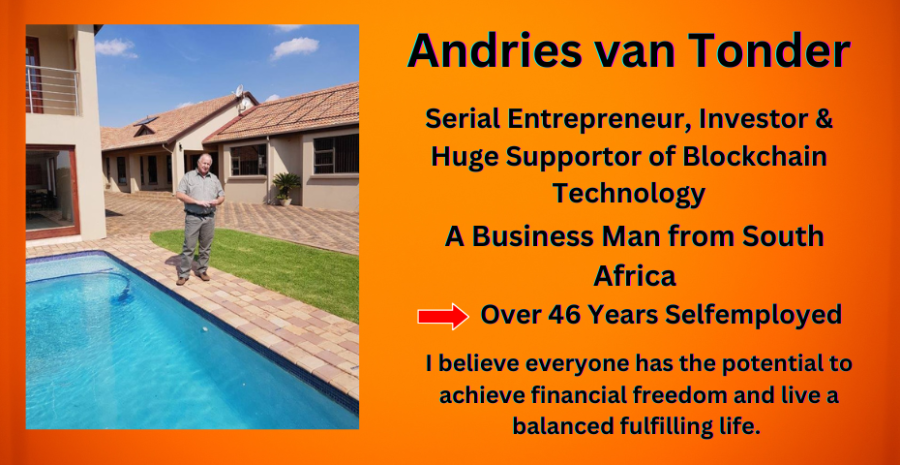

About: Andries vanTonder

Over 46 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me: Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.