By Tim Hakki

Ethereum is the second-largest cryptocurrency by market cap. Image: Shutterstock

This week in coins. Illustration by Mitchell Preffer for Decrypt.

If last week was a mixed bag of flatness for the largest coins, this week offered the first real signs of gains following the catastrophe of FTX’s spiral into bankruptcy.

Bitcoin (BTC) rose 2.7% over the past seven days and currently trades at around $17,000. Its closest rival Ethereum (ETH) grew 6.7% and trades for $1,285 at the time of writing, according to data from CoinGecko.

Both leading cryptocurrencies appear to have begun a modest recovery, after starting the week on a downward slide when news of civil unrest in China rocked risk assets like tech stocks and crypto. Protestors were demonstrating against the country’s ongoing draconian COVID measures, prompting fears that the world’s second largest economy may be getting disrupted.

The market also dipped on Monday on news that crypto lender BlockFi was filing for bankruptcy. BlockFi is the latest in a long line of crypto companies to get hit with contagion following the collapse of crypto exchange FTX.

Risk assets recovered on Wednesday when Federal Reserve Chair Jerome Powell said in a speech that December would bring smaller interest rate hikes. This signals the end of a cycle of hikes—three so far this year, each of 75 basis points—that were the steepest since 1994.

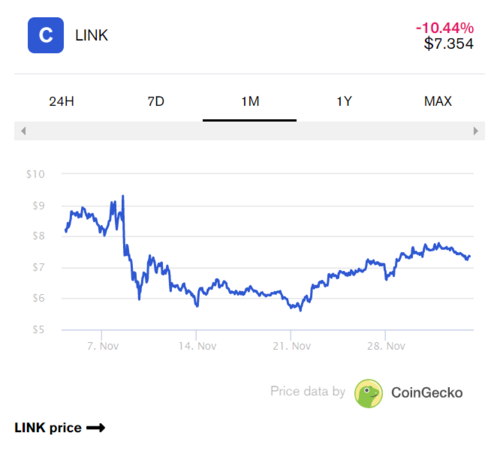

Although the leading currencies almost all posted growth, gains were mostly small. However, several names enjoyed turbocharged rallies, including Chainlink (LINK)—up 11% to $7.59, Uniswap (UNI) blew up 12% to $6.12, and Polygon (MATIC) rose 8.4% to $0.922278.

Dogecoin (DOGE) enjoyed a staggering rally of 21.5% and trades at nearly 10 cents at the time of writing.

DOGE’s weeklong rally was spurred by a tweet from Twitter’s new CEO, Elon Musk, which includes slides from a Twitter company talk he recently gave. One slide mentions “payments” but doesn’t elaborate. However, it was enough to send the Doge Army into speculation that their favorite coin could be the official digital currency of Twitter; it is, after all, Musk’s favorite too.

Lawmakers across the world continue to assiduously monitor and debate the space, especially in the wake of this year’s two largest catastrophes: Terra and FTX. On Monday, Brazil’s congress took a step further than most and passed a bill legally approving crypto for payments for goods and services in crypto.

The bill, which still needs presidential approval, includes crypto and airline travel rewards in the definition of "payment agreements" under the supervision of the country's central bank.

The following day, the European Central Bank published a damning paper that argued that Bitcoin’s lengthy price stabilization at around $20k before FTX’ collapsed may have been “an artificially induced last gasp before the road to irrelevance.”

In the blog post, ECB’s Market Infrastructure & Payments Director General Ulrich Bindseil and advisor Jürgen Schaff also argue that “Bitcoin's conceptual design and technological shortcomings make it questionable as a means of payment.”

Bitcoin friendly U.S. Senator Cynthia Lummis (R-WY)—who co-sponsors a bipartisan House bill called The Responsible Financial Innovation Act calling for the Commodity Futures Trading Commission (CFTC) to be the industry’s chief regulator—on Monday said in a pre-recorded address to the Financial Times’s Crypto and Digital Asset Summit that FTX’s collapse highlights the need for Congress to “learn more” about crypto.

Known as the "Bitcoin Senator" for her cryptocurrency advocacy on Capitol Hill, Lummis touted her bill as a “framework” for understanding how the FTX disaster could have been prevented.

She also noted that FTX was "heavily involved" in drafting the Digital Commodities Consumer Protection Act (DCCPA), which is backed by Senate Agriculture Committee Chairwoman Sen. Debbie Stabenow (D-Mich.) and Sen. John Boozman (R-Ark.)—a bill which she says “needs to be rewritten in a way that is more effective and neutral as to business models, but very, very focused on consumer protection."