Online passive income gives the opportunity to work hard for a week and to keep earning online for a year. The passive online income comes from interest on savings accounts, royalties, dividends from investments, websites etc. Active income features and example If you stop working, you won’t get paid.

If you’re a forward-focused thinker, you may be dreaming about leaving the workforce to enjoy an easier life in retirement or you might even be considering retiring early. But a dream without a plan is just a wish.

To put some wheels on that dream, you need to consider passive income. There are plenty of different passive income options and explanations of how to build it. If you’re new to the idea, I’m about to break it down for you.

Passive income is money you earn in a way that requires little to no daily effort to maintain. Some passive income ideas—like renting out property or building a blog—may take some work to get up and running, but they could eventually earn you money while you sleep.

Your income is your greatest wealth-building tool—a tool that typically requires your active participation in the form of a full-time job. You know what I’m talking about! Even if you love your job, I’m willing to bet you wouldn’t mind earning some extra income without the blood, sweat, tears, and time commitment of another job. In fact, there are several benefits. Building a passive income:

Passive income generally won’t make you wealthy overnight, so forget about any get-rich-quick schemes you’ve heard of. But steady, profitable passive income options can build some serious money over the long haul. We’re talking anywhere from a few thousand dollars to hundreds of thousands of dollars—depending on the income stream.

Passive Income Ideas for 2019 & 2020

Passive income can be built in many ways, but first let’s take a look at what it truly is and which income streams are available.

When we say "passive income," some people tend to think of investing because it can produce the largest results with the least amount of work. But your retirement plan and passive income should be thought of as two separate things.

The whole idea behind long-term investing is to create income for retirement. You want to make sure you’re investing in your company retirement plan, like a 401(k)—if your fund choices are good and they offer a match—in addition to other tax-favored plans like a Roth IRA if they don’t offer a Roth 401(k).

These are great options for building a solid retirement plan, but you will incur taxes and penalties for any withdrawals before a certain age. With retirement planning, you want to let your money grow for the long haul and not touch it!

On the other hand, we want to think about passive income as a type of low-effort income that can be accessed at any time. Let’s take a look at some of these options below.

One way to build passive income after you’re debt-free and have some cash saved up is by purchasing real estate and renting it out to tenants.

Rental property can be a great source of extra income, but it isn’t the most passive choice because you’ll put a lot of time and effort into managing the property—unless you hire a property management company.

I suggest buying close by so you can personally keep an eye on the property. Find a real estate agent who knows your area well so you can buy property in a location that will attract renters.

If you go the rental property route, you need to be in control of your property. I don’t recommend real estate investment options—such as a real estate investment trust (REIT)—that pool your money into properties under its control while other people make decisions about your property for you.

Finally, before you buy rental property, pay off your own home first and purchase your investment property with cash.

Don’t ever go into debt to buy rental property!

If you have a brilliant idea that appeals to a specific audience, you could create something like an educational blog or a YouTube tutorial series to generate online traffic. If your content is engaging and it sees enough daily traffic, you could sell ad space on your blog or ad spots on your channel. After you put in the heavy lifting, you can sit back, relax, and enjoy streams of passive income.

If you’ve discovered how to create content that produces enough traffic to host ads, you could make a product your audience would love to buy. That could be anything from a simple e-book to a complex app that generates income for years after it’s released.

People have a lot of stuff—and they’re always looking for inexpensive ways to store it. What could be easier than having people pay you to store their stuff? Building passive income by offering storage could involve a large-scale investment of buying a storage facility (with cash!) or something simpler like offering your basement or shed. You’ll just need to ensure their items are safe and secure.

Do you have any items you don’t use all the time that others would like to borrow? Useful items like a truck, trailer, trampoline, kayak, or even your own yard could earn you passive income as rental items. This also includes renting out spare rooms in your house with the help of websites like Airbnb. Hop on your favorite social media site, upload pictures of your items, set a price, and tell the world they’re ready for rent.

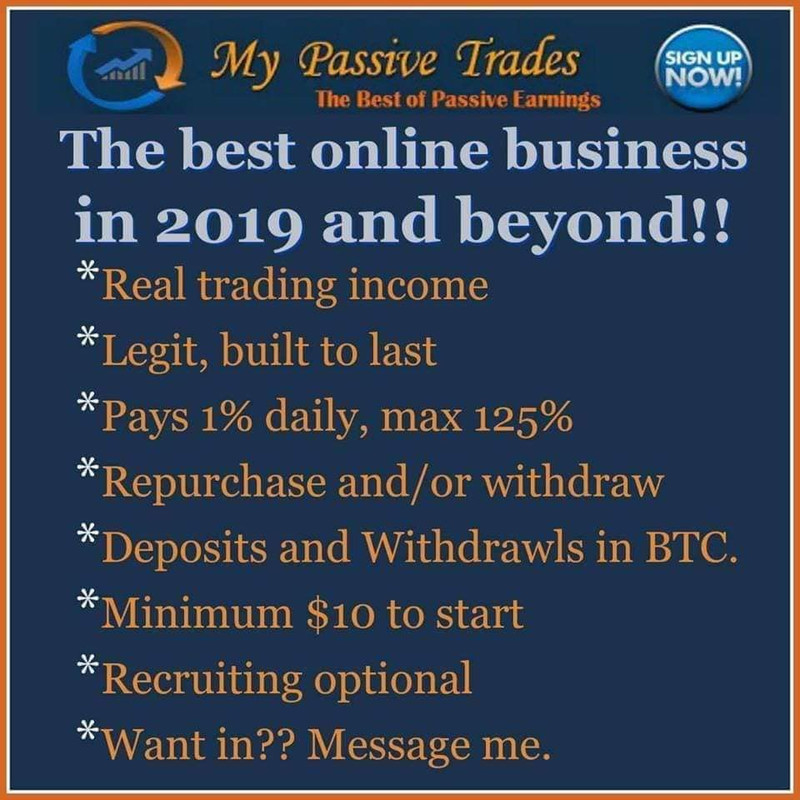

The list of passive income ideas could go on forever. As you search for the best fit, keep an eye out for ideas that show positive long-term track records. Do other people make money on the idea? Has it come back to bite someone who tried it? Some people ask me about passive income options like drink, vending, or other rental machines in public places. The bottom line? Don’t fall for any passive income ideas that promise a quick return or require huge amounts of money upfront. They will sabotage your other financial goals. Look for ideas that are steady, profitable, and trustworthy. Do your research. And never go into debt!