.png)

For beginners...

Hardware wallets are one of the most secure methods for storing crypto. Here we break down what they are, how they work, and if you need one.

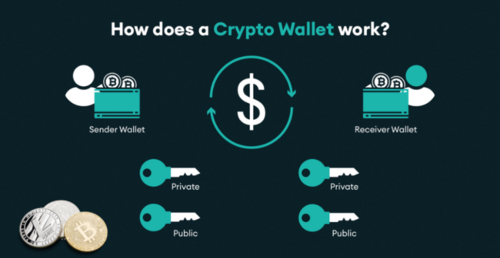

There are two main types of crypto wallets: software-based hot wallets and physical cold wallets. Hardware wallets, a type of cold wallet, provide one of the most secure ways to keep cryptocurrencies. They work by storing your private keys in an external, physical device (usually a USB or Bluetooth device).

Before we dive into what exactly a hardware wallet is, we first need to discuss public and private keys.

Hardware wallets don’t store your crypto itself, but the keys that access it. Here is how that works:

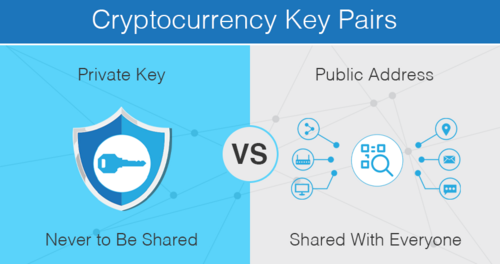

Public and private key pairs are a core component of public key cryptography, an encryption mechanism designed to protect data from unauthorised access. Together, the keys are used to encrypt and decrypt messages and transactions.

These keys are not physical keys, but long lines of numbers that are mathematically related to one another. Because of this link, data that has been encrypted with a public key can only be decrypted with its corresponding private key.

Composed as a long, alphanumeric code, private keys enable you to access, receive, and send cryptocurrency in a trustless manner, where a third party is not required to verify the transactions. Private keys convey final ownership and control over your cryptocurrency.

This concept of trustlessness is a core component of blockchain technology. It seeks to reduce the level of trust participants must place in other individuals, organisations, and even governments, while ensuring that no single bad actor can compromise this system. When you hold your own private keys, you and only you are in control of your finances. No single person or group can tamper with transactions or take control.

Unlike a public key, which is both searchable and shareable, a private key must be kept, well, private. Bottom line is, if you lose your private key, you lose access to your wallet, where your crypto is held. If someone else learns your private key, then they can perform transactions from your wallet on your behalf. For that reason, it’s always advisable to keep your private key offline to limit any risks of hacking.

Here’s an overview of different cold wallets that are secure methods for storing your private keys:

Now that we understand the importance of keeping your private keys safe let us delve deeper into one of the most popular and trusted methods of storing private keys — hardware wallets.

Every hardware wallet is a little different, but the steps are generally the same:

While the security advantages of a hardware wallet are clear, there are some disadvantages that you should be aware of:

There are dozens of cold wallets on the market today. Popular hardware wallets include devices by BitBox02 hardware wallet (One of the simplest hardware wallet for beginners, BitBox02 boasts a fast setup, microSD backup, in-app guide, and intuitive touch sliders.), Ledger and BC Vault.

Crypto.com has collaborated with CoolBitX on a limited-edition Crypto.com x CoolWallet Pro hardware wallet. Readers can enjoy Pay Rewards of up to 2% in CRO when checking out with Crypto.com Pay.

Although hardware wallets are very secure, they are not suitable for everyone, especially not for inexperienced users. Typically, a hardware wallet is cumbersome and includes relatively complex operations and settings that are not beginner-friendly. A hardware wallet user has to back up their information regularly in case of loss, theft, or destruction.

However, if it is peace of mind that you are after and you don’t require the flexibility that comes with hot wallets, then a hardware wallet is usually the best solution.

All examples listed in this article are for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained herein shall constitute a solicitation, recommendation, endorsement, or offer by Luno.com to invest, buy, or sell any coins, tokens, or other crypto assets. Returns on the buying and selling of crypto assets may be subject to tax, including capital gains tax, in your jurisdiction. Any descriptions of Crypto.com products or features are merely for illustrative purposes and do not constitute an endorsement, invitation, or solicitation.

Past performance is not a guarantee or predictor of future performance. The value of crypto assets can increase or decrease, and you could lose all or a substantial amount of your purchase price. When assessing a crypto asset, it’s essential for you to do your research and due diligence to make the best possible judgement, as any purchases shall be your sole responsibility.

Buy, store, and manage your investments with confidence

To Invest in Crypto, click HERE

Join Markethive - the only Market Network on Blockchain, click HERE

*This information should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary for information purposes only and is not investment advice or recommendation. We always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

(3).jpg)

About: Andries vanTonder

Over 40 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me at my Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.