By Mat Di Salvo

.png)

The price of Bitcoin has plummeted (Image: Shutterstock)

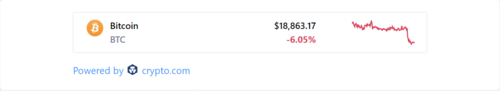

For the first time since U.S. Independence Day, Bitcoin has fallen below $19,000.

The biggest cryptocurrency by market cap was trading for $18,841 at the time of writing, according to CoinMarketCap.

The last time the asset dipped below $19,000 was on July 4, when it hit $18,600. Prior to that, Bitcoin hit $18,900 in November 2020 as part of its run-up to its all-time highs over $60,000 the following year.

Investors appear to be shedding Bitcoin for a number of reasons. As usual, the asset’s sell-off is closely correlated with the U.S. stock market: stocks were down today following a volatile trading session—partly due to fears that the Federal Reserve will continue to hike interest rates.

The Fed’s monetary policy of keeping interest rates high to combat four-decade high inflation has led investors to sell riskier assets—like stocks and Bitcoin.

Bitcoin’s sell-off has intensified following news last week that Russia shut down the Nord Stream 1 pipeline, halting gas to Europe and spooking markets, according to experts. Of course, Bitcoin fans remain undeterred.

Russia’s government said Monday that it would restore gas supplies if sanctions were lifted.

Out of the top ten biggest cryptocurrencies, Bitcoin is one of the worst performers today. Its nearly 5% 24-hour loss has only been surpassed by Polkadot and Cardano, which are down 5.7% and 6.1% respectively in the same time frame.

Ethereum, the second biggest cryptocurrency by market cap, is only down 1.79% in the past 24 hours, priced at $1,568.