By Ryan Ozawa

Image: Shutterstock

The White House today poured cold water on crypto, accentuating the negative aspects of digital assets throughout a massive, 513-page annual report.

The first reference to digital assets in the 2023 Economic Report of the President—issued along with a yearly update issued by the Council of Economic Advisers—asserts that "blockchain technology has fueled the rise of financially innovative digital assets that have proven to be highly volatile and subject to fraud."

And that was on page 43.

"Although advocates often claim that digital assets, particularly crypto assets, are a revolutionary innovation, the design of these assets frequently reflects an ignorance of basic economic principles that have been learned in economics and finance over centuries," the report continues five pages later. "This inadequate design is often detrimental to consumers and investors."

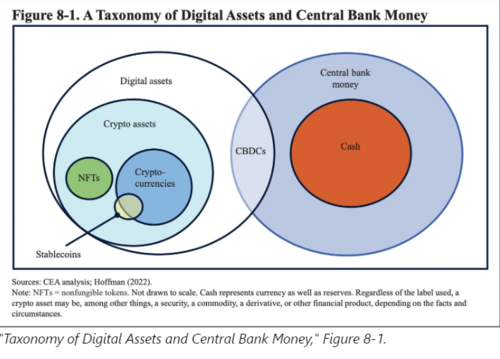

"Taxonomy of Digital Assets and Central Bank Money," Figure 8-1.

"Taxonomy of Digital Assets and Central Bank Money," Figure 8-1.

The overall report—which includes over 100 pages of appendices—covers all aspects of the U.S. economy, including the rise of women in the labor force, climate change, imported goods, foreign investment, and education. But several sections address technology and digital markets.

Chapter 7 is titled "Competition in the Digital Economy: New Technologies, Old Economics." And Chapter 8 takes crypto head on, under the heading "Digital Assets: Relearning Economic Principles."

The conclusion? Crypto advocates need to go back to school, as they are "relearning the lessons from previous financial crises the hard way."

"In addition to the decentralized custody and control of money, it has been argued that crypto assets may provide other benefits, such as improving payment systems, increasing financial inclusion, and creating mechanisms for the distribution of intellectual property and financial value that bypass intermediaries," the authors wrote. "So far, crypto assets have brought none of these benefits."

The costs of crypto, meanwhile, have adversely impacted consumers, the financial system, and even the physical environment.

"Indeed, crypto assets to date do not appear to offer investments with any fundamental value, nor do they act as an effective alternative to fiat money, improve financial inclusion, or make payments more efficient," the authors wrote. "Instead, their innovation has been mostly about creating artificial scarcity in order to support crypto assets’ prices."

"Many of them have no fundamental value," they added.

The authors then work their way through a number of "claims" made by crypto proponents, including the belief that crypto assets could be investment vehicles, could function like money without a central authority, enable fast digital payments, and increase financial inclusion and reduce the unbanked and underbanked.

An extensive list of refutations follow, focused on potential harm to consumers and the lack of regulation and enforcement.

"One of the principal areas where there is mass noncompliance is disclosure surrounding crypto assets that are securities," the report states, before returning to a running theme. "This lack of disclosure prevents investors from recognizing that most crypto assets have no fundamental value."

The council even takes a step back, and takes a stab at explaining Web3.

"Proponents of blockchain technology claim that it will not only improve firms’ performance but also be the backbone of an entirely new Internet—Web3, the so-called new Internet," they wrote.

Citing Signal app founder and cryptographer Moxie Marlinspike, the section concludes that some centralization is inevitable.

"Once a distributed ecosystem centralizes around a platform for convenience, it becomes the worst of both worlds," the report notes. "Centralized control, but still distributed enough to become mired in time."