Are you new to crypto? Or have you been blindly dabbling in the crypto market, getting caught up in hype or FOMO, and not understanding the pitfalls? We’ve all experienced some form of loss, be it falling for a scam or even something as fundamental as entering the wrong address in a crypto transaction.

We can be forgiven for any type of mistake or misguided decision we may have fallen victim to; after all, it is a relatively new industry. But the crypto landscape has now got twelve years of experience under its belt, pundits and enthusiasts have learned (albeit the hard way for some), and the industry has evolved.

According to the Coin Bureau Guy, known for his research and impartial tutorials of all things crypto, including the traps and snags of the cryptocurrency world, for the purpose of this article, I have chosen eight of the most common and catastrophic mistakes the majority of crypto users tend to make. These mistakes are easy to avoid if only you know about them.

Image credit; https://en.bitcoinwiki.org/wiki/Hodl

Everyone who “gets it” envisions crypto as the next sovereign financial operating system, and Markethive and Cardano, are on a mission to do just that. The way it is now, the objective of many users in crypto is to make money and improve their financial situation. That is a great objective and one we all have; however, it isn’t a plan or strategy.

A strategy is vital as it will keep you informed about your investing decisions in a relatively consistent and pre-programmed way. Two of the main approaches to consider are either Trading which requires some technical analysis and knowledge of the markets. It curbs you from making quick and sometimes emotional decisions when trading particular coins. The other is Hodling;

More often, newbies starting out prefer to hold their crypto in a safe wallet. Hodling your chosen crypto will set you up for more long-term gains. Deviating from well-thought-out plans most often result in loss and heartbreak, as confusing changes can make it more challenging to know why your investments are not going according to plan.

So many have lost all their funds by simply choosing an exchange which turned out to be a scam. As the crypto market is still deemed the wild west, there are 100s of new exchanges springing up, with some having very questionable business practices.

There are many legitimate exchanges out there, and a little research to find a safe and trustworthy exchange is needed and will pay off in the long run.

It is becoming more apparent that the paid ads on crypto new sites are not impartial. Checking the forums at Reddit or BitcoinTalk can be an excellent way to see if there are worrisome trends regarding an exchange.

You need to make sure the exchange has the coins or tokens you want to trade. You can find this information on either CoinMarketCap or CoinGecko. They are all easily verifiable on these sites. Also, verify that the exchange allows your country’s currency.

Another thing to consider is if the exchange has restrictive policies for withdrawal procedures and if the interface is user-friendly. And watch out for those fees - From the trading fees to the deposit and withdrawal fees, they can vary and be quite expensive and certainly add up over time.

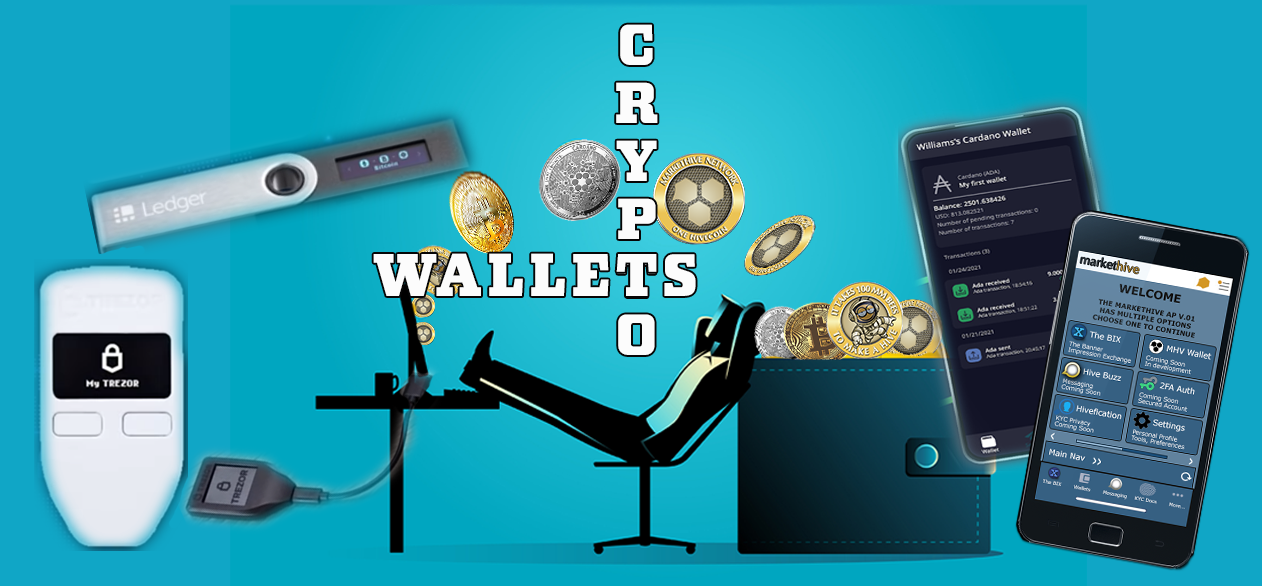

There are many stories with unfortunate outcomes simply because crypto newbies chose to hodl and store all their coins on an exchange. It’s been notoriously easy to hack an exchange resulting in enormous losses for the exchange and customers.

Having a small amount in an exchange is ok, but for people with large portfolios, hardware wallets are recommended and are the safest way to keep your coins from remote attacks by hackers. This is predominantly for crypto enthusiasts who want to hodl their diverse range of altcoins and, of course, for the Bitcoin pioneers that were smart enough to gather their BTC all those years ago.

Crypto projects built on their own blockchain will have their own wallet apps, which can be considered safe to Hodl and transact. Like ADA on the Cardano Blockchain, ERC20 on the Ethereum Blockchain, and Hivecoin on the Markethive Blockchain. Another big plus for hodlers is that staking is also available via these apps.

4 - Not Keeping Backups For Wallets And Exchanges

How many times have you read news about some poor fellow losing his passwords to his wallet and can’t access their Bitcoin fortune?

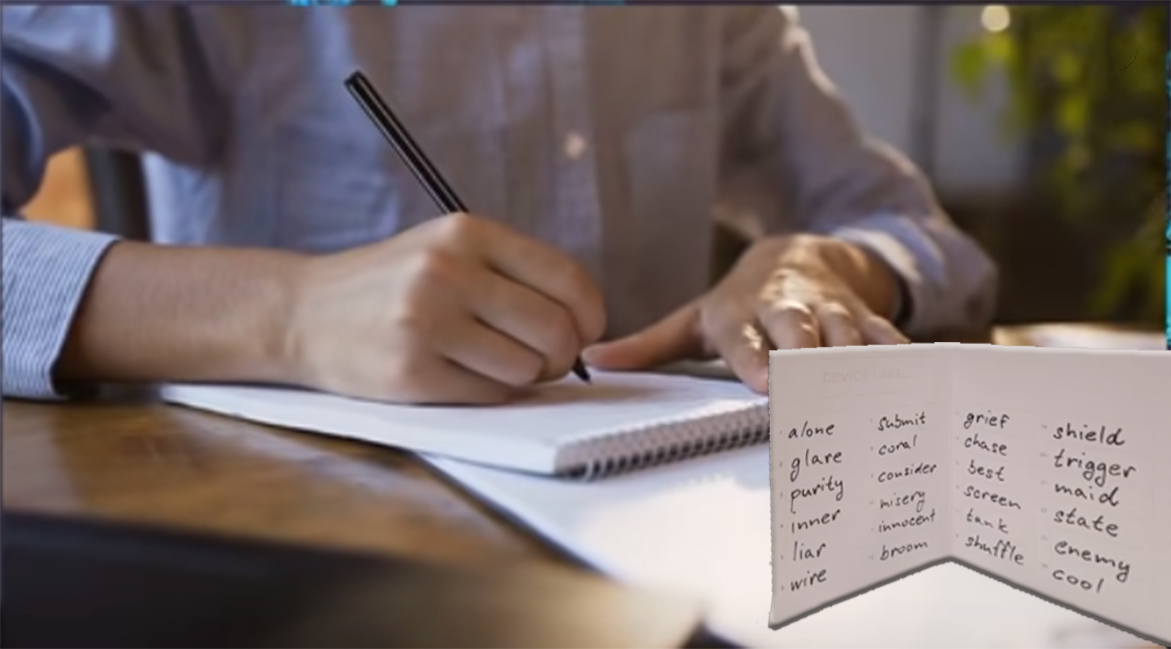

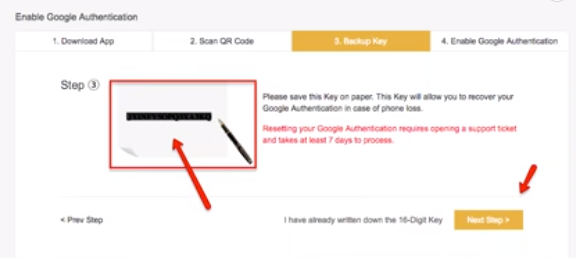

It’s crucial to make regular backups of all your seed words on paper. You will also want to make sure that you have backups of exchange passwords and two-factor authentication seeds.

Are you aware that when activating your two-factor authentication, there is a backup code to reset your two-factor connection if you lose your phone? The only other way to reconnect to a new phone is a complicated and arduous verification process through the exchange.

So be sure to write down all the codes and phrases in the order they are given to you, and keep them hidden in a safe location. (Don't be like me and forget where you put them :D) Some have even opted to store them in a safe deposit box, especially those with large portfolios.

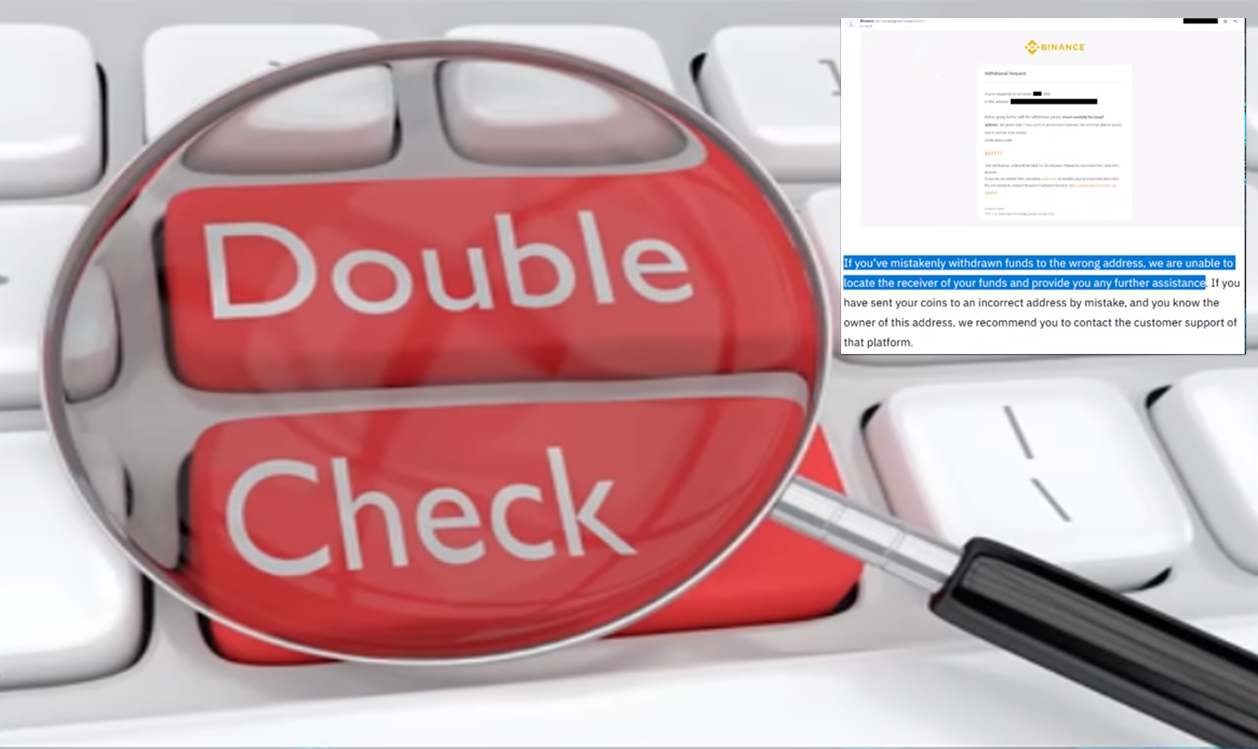

Sending crypto to a crypto exchange on an unsupported blockchain is one of the most common mistakes. Too many newbies send funds to the wrong address as they do not check whether that particular crypto is listed on the exchange.

You always need to make sure that you are sending that crypto to the correctly supported chain. There are also distinct differences in the address of the various cryptocurrencies. Once the funds have been sent to the address, it cannot be recovered in most cases.

For example, Ethereum: prefix is 0x32Be3, and Bitcoin: begins with the number 1, 3, or bc1.

Cardano has three types of addresses - Icarus-style: Starts with Ae2, Daedalus-style: Starts with DdzFF, and the Shelly Era begins with addr1. Notably, Daedalus shows an error message if you input an address that is not valid (for instance, when using an address from a different network.)

It is advised to make a test transaction with a smaller amount to ensure that all is working correctly and that it is being picked up on the other end.

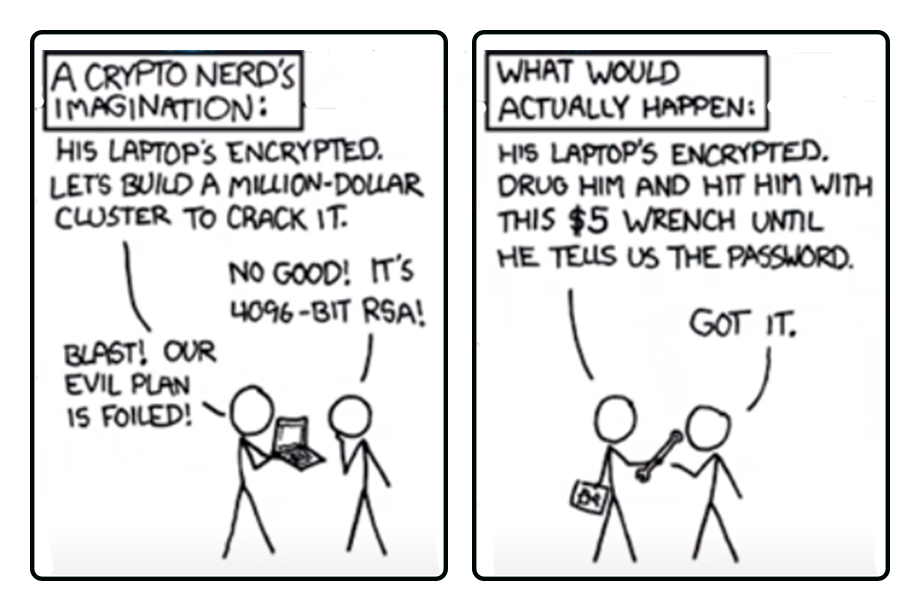

Don't tell people how much crypto you hold and that you are invested in crypto. Also, don’t disclose the name of your wallet or where you have your hard wallet stored. There have also been cases of people asking for help on forums revealing their worth.

Many brag about their good fortune showing screenshots of their wallet balances on social media. It’s surprising how much information can be gleaned from your social media profiles by potential scammers.

Not a good idea - No one needs to know how much you have or where you have it, and when you do this, you open yourself up to a robbery or worse. Have you ever heard of the $5 wrench attack? That’s just one and very real way they can get to you, up close and personal.

The most common mistake of them all is falling for a scam. We’ve all been there. But despite how far the crypto industry has evolved, there are still many scams infesting the crypto space. They range from Ponzi schemes to giveaways, pump and dumps to phishing attacks, and that’s another whole other article which I haven't written yet, or you can cut to the chase and watch this.

Some are blatant and can be spotted easily; others are more subtle and can be very convincing. Like everything else, scammers are evolving and adapting and have even conned people who think they have a handle on these scams and are immune to them.

All these scams follow are similar modus operandi. They all appeal to either greed or your fear and expect you to make a quick decision without thinking things through, and of course, there will always be newbies that are oblivious or walk around with rose-colored glasses that will be ripe for the picking.

That is why the next section on DOYR is so critical to your crypto journey.

Not DYOR is one of the most fundamental pitfalls people tend to make and the most underrated investment edge. Most rely on tips from others which can lead to disastrous results. DYOR enables you to take ownership over your investment decisions, and just maybe, you will uncover those hidden gems quietly coming up through the ranks. It also improves your long-term education in the crypto landscape.

Watching interviews with the founders and CEOs of a cryptocurrency project is an excellent way to understand and measure its potential. Also, reading a company’s blog is usually sufficient to get a sense of being true to its word, transparency, and where the project is headed. Checking out the white paper and road map to see if milestones are being met is also a must.

To be considered a sound investment, a cryptocurrency must have the following criteria;

Also, the market cap of at least a few hundred million dollars with good exchange support and ample trading volume once a coin is listed on reputable exchanges. Be mindful, however, that the coins in circulation are distributed across the community, and not held by the founders or a few large investors only. This is generally a red flag.

Notably, given the various utility and technological advancements of Smart contract coins, they are an extremely viable prospect going forward.

Tread carefully with coins that have no purpose for utility. Dogecoin, for example, was created out of a meme as a joke by two guys, Billy Markus and Jackson Palmer. They used a guide they found online on how to clone scrypt based altcoins for fun and profit.

“The original intent was a parody of all the serious clone coins that were trying so hard to differentiate themselves, but all seemed the same”, Marcus said. He added that it is one of the most volatile assets on the market.

Community is integral to a project, and although the community has grown with Dogecoin, it seems the main thrust is the novelty and the power of social media and endorsements. Having no genuine use-case gives rise to pump and dumps and chronic manipulation.

Elon Musk, a recent Doge fan, advocating and tweeting about the clone coin, resulted in a parabolic shift in the price. Since the SNL parody featuring Elon Musk, the coin tanked, revealing the volatility and manipulation whales and celebrities can invoke.

Charles Hoskinson, CEO of Cardano, spoke about Doge in a recent video and his concerns for legalities and enforcement that can negatively affect the crypto industry due to market mania.

One of the founders of Dogecoin, Jackson Palmer, left the project, citing his concerns about the space being overrun by opportunists looking to make a buck rather than people investing in evolving the technology.

It’s crucial to take a step back and look at the bigger picture. The cryptocurrency market is still relatively new and has a lot of growth to come. Most of us have missed the Bitcoin bullet train of ten years ago, but there are gems out there going the extra mile, staying a step ahead and constantly evolving with emerging technology, addressing real-world issues that will give you a good return on your investment and make a sustainable, long-standing difference in the global economy.

Not just for the fun of it, but for the good and well-being of all humanity and securing a sustainable and prosperous future.

*The information contained in this article is for informational purposes only. It is not financial or legal advice of any kind.

Written by Deb Williams

Chief Editor and writer for Markethive.com, the social, market, broadcasting network. An avid supporter of blockchain technology and cryptocurrency. I thrive on progress and champion freedom of speech and sovereignty. I embrace "Change" with a passion, and my purpose in life is to enlighten people en masse, accept and move forward with enthusiasm.