Although Bitcoin has existed for 15 years, the crypto industry is considered relatively nascent, and it’s frequently stated as still in the early days, meaning that many coins and tokens still have huge potential. Many believe this is somewhat underestimated. In perspective, the total market cap of stocks is $90 trillion, the total market cap of precious metals is $15 trillion, and just the US Dollar is over $20 trillion. The total market cap of crypto is only around $1 trillion, and considering some coins and tokens could someday become serious competitors to stocks, metals, or even national currencies means that crypto still has unprecedented potential.

This article explores the six steps to achieving crypto’s full potential, how it will achieve this potential, what entities are moving forward, and how significant the returns could be. We’ll look at where we’ve come from and where we are heading and discover the critical component that brings this whole approach together.

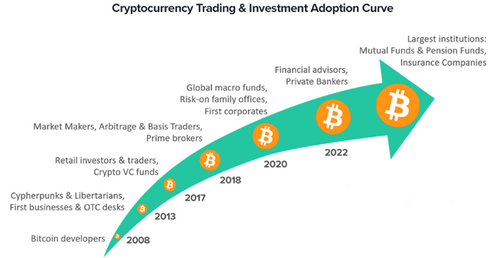

Image source: Finoa.io

The first step to achieving crypto's full potential is awareness and education because crypto can only receive investment or achieve adoption if people know about it. It can only receive investment or achieve adoption if people understand how it works and its value. Awareness of and education about crypto needs to be improved, as most of the attention either comes from mainstream media, arguably biased and aligned with the financial establishment, or from misleading advertisements, promotions, and partnerships, often from explicitly pro-crypto entities.

Much of the education has also come from questionable sources, with most media outlets and influences pushing content purely to get clicks or token allocations. The result is that there is a general shortage of quality information about crypto, but this is improving. People are looking for quality information about crypto, and it’s increasing.

Another reason there’s been a lack of genuine education in crypto until now is that it's often more profitable to do other kinds of crypto content in the short term. It has given cryptocurrency an unfavorable reputation and is especially tough for those genuinely trying to educate others, but this seems to be slowly improving, too.

Some crypto content creators and influencers have taken shortcuts, finding themselves under the scrutiny of the SEC, while other countries have recently enforced strict regulations around crypto marketing. As concerning as some of these regulations are, they are arguably necessary to ensure that the next wave of crypto content creators and influencers focus on crypto content with long-term value.

Markethive, an entrepreneurial ecosystem, is a platform at the forefront of this shift as a next-gen crypto media outlet that champions free speech, focusing on genuine crypto content and education. The overall crypto landscape is at the beginning stages. Still, by the time the next crypto bull market hits, the quality of crypto awareness and education will be much higher than it has been, which will set the stage for crypto to reach its full potential.

The second step to achieving crypto's full potential is regulation. It ties into the first step because regulators must know about crypto to write reasonable regulations. Institutional investors also need to be aware of and educated about these regulations. As we've seen, regulators worldwide are both aware of and educated about crypto for the most part. This is fortunate or unfortunate, depending on the jurisdiction in question.

It's becoming clear that some are pushing for pro-crypto regulations while others are pushing for anti-crypto regulations. Believe it or not, any crypto regulation will benefit the crypto market if it doesn't involve an outright ban. This is just because investors, notably institutions, will finally have some guidance about what they can and can't do with crypto in their country. And once these investors and institutions get involved, you can bet that they will lobby to improve crypto regulations to suit their needs better.

The crypto industry has already been lobbying but with mixed results. By contrast, Fidelity privately lobbied the SEC to approve a spot Bitcoin ETF in September 2021. For context, Fidelity is one of the largest asset managers in the world. It was arguing with an anti-crypto regulator behind closed doors, which is highly bullish.

In retrospect, it's possible that Fidelity's lobbying is why Black Rock became encouraged to file for a spot Bitcoin ETF in June 2023. More importantly, Fidelity's past lobbying and Black Rock’s present SEC filing suggest that these lobbying efforts will only increase. This will ultimately be a net benefit to the crypto market.

The third step to achieving crypto's full potential is investment from institutions and high-net-worth individuals. Of course, these entities hold most of the world's wealth. This is a consequence of having currencies whose supply is manipulated by people in power. Like all investors, institutions and high-net-worth individuals ultimately want to maximize their returns. As it happens, Bitcoin’s BTC is estimated to be the best-performing asset of all time, from an initial price of $0.09 to all-time highs of over. $69K, BTC has pulled a 760,000X return.

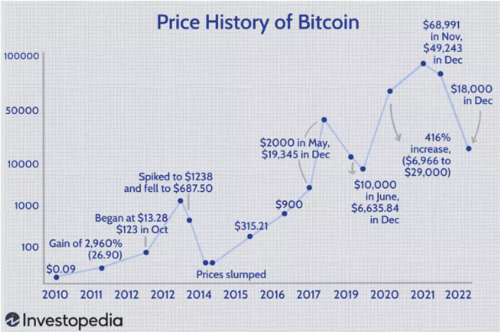

Image source: Bitcoin’s Price History

Like all assets with such high returns, BTC’s returns will likely diminish over time, but it will still ostensibly outperform most other assets for the foreseeable future. This fundamentally depends on how much BTC we'll see in inflows. Although this is impossible to predict, there is one benchmark to remember;

BTC is considered by many investors, including Black Rock, to be digital gold. As a result, it's generally believed that BTC’s market cap will someday be similar to that of gold. Now, gold's market cap currently sits at around $13 trillion. BTC's market cap is currently sitting at approximately $500 billion. So, BTC catching up to gold would mean a 26X increase in its price. This would translate to a BTC price of around $670,000.

Interestingly, BTC’s peak price of $69K put its market cap at around $1.3 trillion, around 10% of gold's total market cap. This assumes that BTC is analogous to digital gold. Some have argued that BTC has additional value since Bitcoin is technically the most secure network in the world. It makes it the ideal base for other ecosystems, including payments, which the likes of the Lightning Network can support. On the topic of payment networks, smart contract cryptocurrencies are the ones that will capture this market share. It means that they could someday displace payment processors and other financial intermediaries.

The total market cap of these financial intermediaries is over $2 trillion. Given that the market cap of Ethereum’s ETH is currently around $200 billion, matching analogous companies would mean a 10X increase in price. It translates to an ETH price of over $15K, but this likewise assumes that Ethereum is just a payments network; it is obviously much more than that. As such, one could argue that Ethereum is still near the beginning of its adoption curve.

The fourth step to achieving crypto's full potential is adoption. For reference, it's estimated that less than 5% of the world currently holds crypto. This implies that should more people choose to hold crypto, its price should have excellent upside potential. However, holding crypto is not the same as using crypto. Holding it constitutes investment effectively, whereas using it is actual adoption.

On-chain data for the largest cryptos suggests there are only a few million daily users, a mere fraction of the world's population. Therefore, potential gains are even more significant than expected by merely extrapolating hodlers. For those unfamiliar, there are ultimately three reasons why people adopt crypto. The first is for profit, the second is for fun, which is very much intertwined with the first reason, and the third is out of necessity. This third reason has resulted in most of the actual crypto adoption.

For example, 50% of Nigeria's population uses crypto daily, primarily because the government can't be trusted. This phenomenon is not unique to Nigeria; it's an accelerating trend worldwide. Considering that most central banks are currently rolling out Central Bank Digital Currencies (CBDCs), it becomes easy to imagine a world where the average person starts looking for alternatives to a digital currency controlled by institutions they don't trust.

The demand for such alternatives is already increasing among some governments. The so-called Global South is looking to move away from the US dollar, and some reports suggest that crypto could be a part of their escape plan. Some countries already use crypto for international trade, and Russia is considering mining its own crypto.

So, just like the adoption process at the individual level, the adoption process at the national level will eventually involve nations and national activities. Using crypto for things like international trade will become more accessible to the average country. At the same time, the tendency to weaponize fiat currencies will be increasing, and this will increase the demand for credibly neutral currencies. Decentralized cryptos like BTC could play a key role.

Crypto Adoption will ultimately depend on the progress of crypto innovation, the fifth step to achieving crypto’s full potential, particularly around user experience and privacy. Logically, it will be hard for individuals and institutions to adopt crypto in any meaningful way if they need to struggle with hardware wallets.

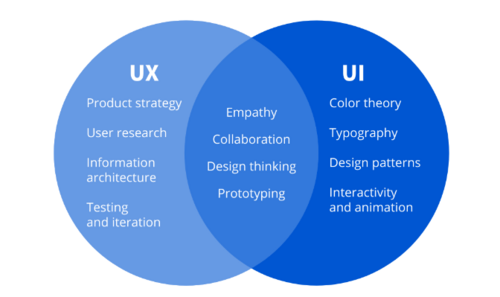

Image source: Coursera.org

Significant developments have been on this front, the most notable of which is the gradual merging between hardware and software. It might sound bizarre, but a crypto phone like Solana Saga could solve crypto wallet User Interface (UI) and User Experience (UX). It's not just wallets, either. A lot of innovation is happening at the blockchain level.

For instance, Ethereum’s EIP 4337 upgrade from earlier this year will allow any phone to have crypto phone-type properties, mainly hardware wallet-level security. It will also make it possible to create dApps with no gas fees or, rather, dApps where the user doesn't have to pay the gas fee.

Constantly checking and accounting for transaction fees is another considerable hurdle to crypto adoption, which many crypto projects attempt to overcome. This will require entirely new approaches, such as charging crypto users monthly subscription fees to use a blockchain rather than charging them for every individual transaction. Of course, some of these approaches will require entirely new types of hardware, like more interactive hardware wallets.

Crypto privacy is another niche to watch out for. Privacy in crypto has been a touchy subject. In one respect, crypto transparency is a huge advantage. At the same time, some degree of privacy is required for financial freedom, and high-net-worth individuals demand it. When it comes to the incessant third hand of government, there's a desire to exploit crypto’s transparency to track transactions and label any crypto privacy attempts as inherently encouraging criminality.

For the crypto industry, balancing transparency with privacy presents a challenging problem. Zero-knowledge proofs have emerged as one potential solution to this problem, but they come with other problems. The primary one is ensuring that these zero-knowledge technologies don't have secret back doors. Thankfully, this is an issue that can be addressed.

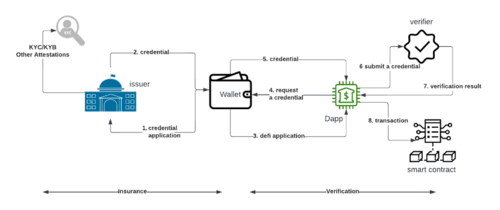

Image Source: Developers:Circle.com

Regardless, the problem of balancing transparency with privacy is closely related to the problem of identity. Countries are pushing for digital IDs, and global regulators want to see these digital IDs integrated with cryptocurrency. The crypto industry has been working on its own supposedly decentralized digital ID solutions; however, these digital ID Solutions are just as centralized as the ones from governments. What's needed is a truly decentralized digital ID.

There haven’t been any significant developments yet; however, the innovations around wallets and privacy continue rapidly and should be in place by the time the next crypto bull market comes around. This will further facilitate crypto investment and adoption at individual and institutional levels.

Cryptocurrency's final step to achieve its full potential is complete decentralization. Without decentralization, everything that I just mentioned is off the table. That's because if crypto is centralized, it can be controlled, and if it can be controlled, it'll end up like our existing systems—news flash: Crypto's entire purpose is to replace our current systems with something better, starting with our monetary and financial systems. Naturally, the technology that underlies crypto is compelling. The only way it won't fall into the wrong hands is if it's genuinely decentralized.

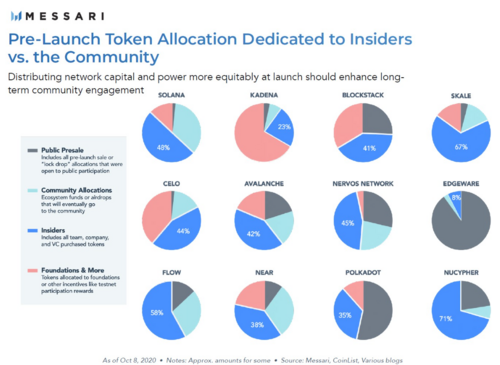

This article illustrates that decentralization means more than having many validators or miners. It means having a decentralized developer base, a decentralized coin or token distribution, a decentralized infrastructure layer, and a decentralized blockchain. Ultimately, this also means having a truly decentralized internet.

Luckily, the Internet is somewhat decentralized and will likely become more decentralized as peer-to-peer Internet crypto projects like Helium see more investment and adoption. This also pertains to Markethive as it strives to decouple from all centralized entities prevailing as a tour de force in its next-gen social market broadcasting media niche. This adoption is necessary due to internet censorship.

Currently, most cryptocurrencies are arguably not decentralized enough to evade control. It stands to reason, then, that these cryptocurrencies will not be the ones that make it. In other words, if you hold centralized cryptos, you're not early; you're late, very late. That said, this depends on whether the centralized cryptos you currently hold can become decentralized. To figure this out, you must ask one question: Is this crypto capable of building its own infrastructure and ecosystem without relying on a single set of individuals or institutions?

Image Source: X - The DeFi Edge

The answer for most cryptos is no; however, that's not entirely their fault. One perspective is that one of the primary reasons why so many cryptos are so centralized is because of funding. Early investors in crypto projects want to see returns and often try to control the project to that end. This incentivizes crypto projects to cut corners on decentralization to ensure their investors are quickly rewarded. As we've seen, these so-called VC coins have seen the most aggressive pump-and-dump cycles, and most of them probably won't last past the next crypto cycle.

The silver lining to this situation is that it fully displays the solution to the crypto centralization problem. The crypto industry needs to find a way to fund crypto projects in a more decentralized manner.

Image by Markethive.com

Markethive is the ecosystem for entrepreneurs and a crypto project with the solution to top-level control issues, whether it be funding or the systems driving it. It is a decentralized, limited AI-secured rating and reputation system that is self-policing and a Human Intelligence (HI) that fosters a healthy level of meritocratic interaction. The community solely funds it with no prominent venture capitalists. The people are building it; it is of the people and for the people, so the community will profit, sharing the prosperity and abundance of every level of humanity.

It also creates a breeding ground for positive, creative, and beneficial content in which people's minds are prompted toward positive growth and critical thinking. Markethive is beyond its crypto wallet and Hivecoin release milestones, disengaging unreliable APIs and implementing multiple servers in preparation for its mining hives that give peace of mind—making it an impenetrable fortress against what has become a jungle, and a cesspool of fraud, scams, data harvesting, political bias, and dystopia.

This divinely inspired project is all part of the Web 3 or 3rd generation Internet, which has emerged as a movement away from the centralization of services. Markethive is here for the rank and file with entrepreneurial aspirations at little to no cost to join. The all-encompassing social market broadcasting network delivers financial sovereignty, freedom of expression, privacy, and autonomy. We have entered into the much-needed world of decentralization, where the cancel culture is no longer an existential threat.

At the time of writing this article, we are perfectly positioned to take advantage of the opportunities that are coming. Markethive, with its Hivecoin (HVC), will be poised for the next crypto bull run and participate in the facilitation of crypto achieving its full potential, where we’ll see HVC firmly established as a coin with purpose and utility in the free market. Do you want to be part of the decentralization revolution? Today, become an ‘Entrepreneur One’ and reap the rewards of Markethive’s ILP and revenue returns.

May God bless and uphold you for all eternity...